Taking Stock 2020: The COVID-19 Edition

In our 2020 annual outlook of US greenhouse gas emissions, we focus solely on the largest source of uncertainty in the current outlook for US emissions: COVID-19’s impact on the economy.

For the past six years, Rhodium Group has provided an independent annual assessment of US greenhouse gas (GHG) emissions and progress towards achieving the country’s climate goals. Each year, we explore changes in federal and state policy, shifting energy market and technology advancements, and expectations for growth of the US economy—all of which are central drivers of the outlook for US GHG emissions over the coming decade. However, this year’s edition is different. Here we focus solely on the largest source of uncertainty in the current outlook for US emissions: COVID-19’s impact on the economy.

It has been over 100 years since the US has confronted a pandemic of this magnitude, so there are few historical precedents for understanding what to expect over the coming years. There are four main components of uncertainty: 1) the epidemiological outcomes of COVID-19 and its spread; 2) how states, companies, and communities respond to the epidemiological risks through lockdowns or restrictions on activity; 3) the resulting impact to the US economy; and 4) the response of federal and state governments to shore up the economy through stimulus and recovery measures.

In this report, we provide a range of potential scenarios for the first three sources of uncertainty. We plan to explore the fourth source of uncertainty in subsequent research. These scenarios provide a starting point for policymakers as they consider policies to both stem economic losses and invest in efforts to decarbonize and improve the resilience of our economy.

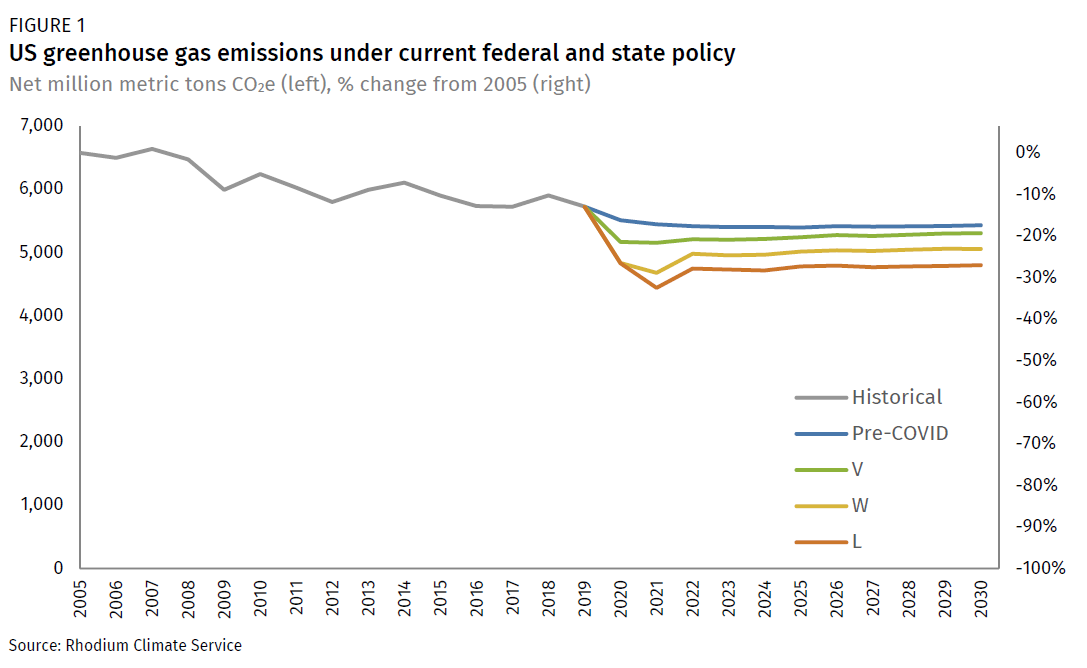

The spread of COVID-19 has already substantially reduced GHG emissions over the past few months. We estimate that between March 15 and June 15, emissions declined by 18% compared to last year’s levels. Less clear is how the crisis will shape emissions in the years ahead. We find the potential for a persistent effect on GHG emission trends—with reductions of 6-12% this year relative to pre-COVID projections, and 2-12% by 2030, depending on the depth and duration of the crisis and the pace of recovery (a V, W, or L-shaped recovery) (Figure 1).

COVID-19’s most dramatic effect to date has been in the transportation sector. Between March 15 and June 15, transportation emissions declined by 28% compared to last year’s levels, as air travel and personal vehicle usage have plummeted. In our post-COVID economic recovery scenarios, we expect the crisis to continue to disrupt transportation more than any other energy sector. The range of emission reductions could be between 1 to 14% below the pre-COVID baseline by 2030, depending on the pace of economic recovery and the extent of lasting behavioral changes.

In the electric power sector, overall demand has weakened in response to COVID-19. This, combined with low natural gas prices, has accelerated coal’s long decline. At the peak of the lockdown, coal generation was down more than 30% year-on-year, with wind and solar generation surpassing coal for the first time in US history. Already in trouble before the pandemic, coal gets hit even harder in our post-COVID scenarios. However, while power sector emissions continue to trend downward, they flatten out by the mid-2020s due to the expansion of cheap natural gas.

Cheap natural gas, along with growing domestic oil production in recent years, has also bolstered industrial demand, driving up emissions. While the pandemic has dampened the steady rise in industrial emissions somewhat, in our post-COVID scenarios we find that industry remains on track to become the largest emitting sector in the next six years.

Overall, despite the sharp near-term drop in emissions, it falls far short of the scale of reductions needed to put the US on track for deep decarbonization and net zero emissions by mid-century. These emission reductions are achieved almost exclusively due to decreased economic activity and not from any structural changes that would deliver lasting reductions in the carbon intensity of our economy. Near-term emission reductions driven by COVID-19 also come at an enormous economic cost—$3,200-5,400 per ton of CO2 reduced, on average this year.

Timely and well-targeted clean energy and climate investments made as part of sustained stimulus and recovery efforts can help shorten the duration of the crisis, accelerate the recovery, and deliver emission reductions based on sustained transformational changes needed to reach long-term decarbonization.

For more information about our approach and methods, see the Taking Stock 2020 Technical Appendix.