Lower for Longer: The New Normal of China’s FDI Balance

After running a surplus of foreign direct investment (FDI) for the past three decades, China’s FDI balance turned negative for the first time in 3Q 2015. By 1Q 2016, China’s FDI deficit had extended to -$23 billion. This note explores the drivers behind this development and discusses the implications and possible policy responses from Beijing. The key findings are:

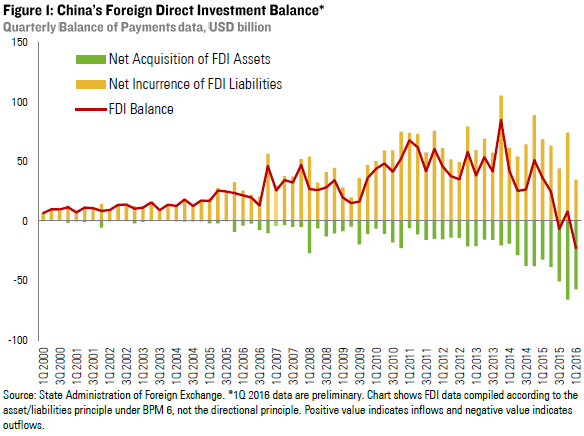

China’s FDI deficit is driven by secular trends as well as short term sentiment: The swing in China’s quarterly FDI balance from an average surplus of $36 billion in 2014 to a deficit of $7 billion in the past three quarters was driven by a combination of secular developments, mostly the spectacular growth of outbound FDI by Chinese companies, as well as shorter term reactions to changing exchange rate expectations and lower returns on investment in China.

Beijing is facing a new FDI normal: While US dollar weakness may have taken off some of the shorter term pressures in 2Q 2016, China’s FDI balance will not return to its previous structural surplus. Outbound FDI will remain a core driver of outflows, and the slowdown in Chinese growth as well as greater exchange rate volatility have spelled the end of the carry trade that propelled foreign companies to pile funds into renminbi holdings in China. China’s leaders cannot take the enormous FDI surplus of the past decades for granted any longer, and there is significant risk for the deficit to worsen.

Continued scrutiny for outbound flows and a new imperative for reforming inward FDI policy: A permanent and possibly further expanding FDI deficit is a concern to Chinese policymakers as it further amplifies capital outflows through other channels and reinforces the narrative of declining investor confidence in the Chinese economy. While we don’t expect Beijing to fully reverse recent liberalization measures for outbound FDI, regulators will continue to closely monitor outflows through the FDI channel and informally crack down on certain transactions, especially those with financial nature. More importantly, we expect more pressure building up for increasing the level of FDI inflows, including more aggressive liberalization of the FDI policy environment and better access to sectors that are currently closed or restricted for foreign investors.

The Big Swing

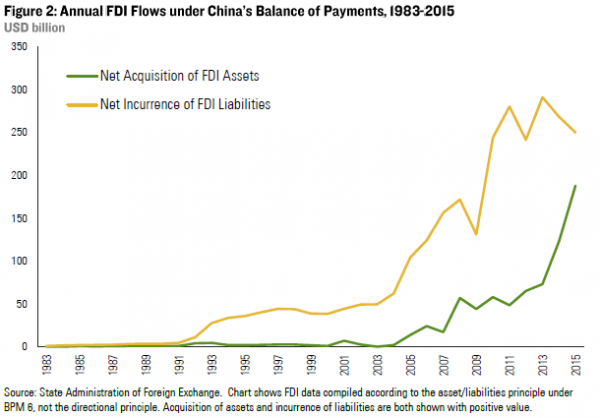

China has run a foreign direct investment (FDI) surplus for more than three decades. Inviting foreign capital and expertise was a core pillar of China’s opening up policy since the early 1980s. By 2015, China’s FDI stock had grown to more than $2.8 trillion, reflecting its attractiveness as a competitive manufacturing location, a large consumer market and an attractive emerging market with double digit growth and a gradually appreciating currency. Outbound FDI (OFDI) activities by Chinese companies on the other hand were heavily restricted for most of the past thirty years.

As a result, China has run a significant FDI surplus under the financial account every year since the beginning of data recording in 1982. The global financial crisis caused a temporary drop in FDI inflows in 2008 and 2009, but inflows picked up again in subsequent years, taking China’s surplus to new record highs. From 2010 to 2014 China’s FDI surplus averaged $200 billion per year as foreign investors were attracted by world-beating economic growth, a fast-growing middle class and a one-way currency bet.

These long-standing patterns changed dramatically since the second half of 2015. In 3Q of 2015, China’s BOP recorded its first quarterly FDI deficit (-$6.7 billion) in three decades. After a small bounce back in 4Q ($8 billion), China’s FDI balance fell further to -$23 billion in 1Q 2016 (Figure 1).

Secular Long-term Trends

The first factor responsible for this stark deviation from long-standing FDI patterns is the catch-up of Chinese companies on outbound FDI. For most of the past decades, outward FDI remained small as few Chinese companies had the incentives, the ability and the permission to invest overseas.

All this has changed in the past few years: Chinese companies feel growing pressure to internationalize to adapt to new economic realities in China; they are increasingly capable of competing for international assets and putting them to productive use; and the Chinese government has gradually relaxed restrictions on overseas FDI in the past decade, with particular aggressive liberalization steps in the past three years.

As a result, Chinese outbound FDI has grown exponentially since the early 2000s. The annual net acquisition of FDI assets in the BOP surged from less than $20 billion before 2006 to almost $190 billion in 2015 (Figure 2). Available proxy data from China’s Ministry of Commerce confirm that the bulk of this increase in foreign assets can be attributed to a spectacular jump in outward FDI by Chinese companies.

The trajectory of foreign direct investment into China is the opposite. The net incurrence of FDI liabilities has jumped in the aftermath of the financial crisis but then plateaued in 2010 and barely grew in the past five years. Anemic FDI growth is partially a reflection of slowing Chinese growth and structural changes such as higher costs for labor and other factor inputs. It is also a result of China’s slow progress with reforming its FDI policies. China still restricts foreign investment in many industries, among them some of the most attractive growth sectors such as high-tech manufacturing and advanced services, and recent commitments to create a more level playing field for foreign investors have not yielded substantial changes.

FDI as a conduit for Financial Investments

While the structural story is key to understand the swing in China’s FDI balance, shorter term concerns about the Chinese economy and exchange rate stability are also important to consider. FDI is generally considered the most “sticky” type of capital flows, and Chinese officials are right to point out that the majority of the FDI stock in China is in illiquid assets and thus shorter term investor sentiment does not affect FDI patterns to the same extent as other types of capital flows. At the same time, the line between FDI and portfolio investment is often blurry, and recent patterns illustrate that shorter term sentiment is indeed an important factor shaping FDI patterns.

On the inbound side, foreign investors have long used FDI to gain exposure to the Chinese economy and currency, as other legal channels to move money into China were barely existent. The extent of shorter term nature FDI flows is unclear and difficult to exactly determine, but the patterns of Chinese inward FDI show a correlation with currency expectations and price movements in certain asset classes such as real estate.

The same is true for Chinese outbound FDI now. Chinese companies and individuals face very high formal restrictions for legally investing money overseas, and the government has further tightened available grey channels in past months. The OFDI channel on the other hand has become relatively open after the recent rounds of liberalization, allowing private firms to invest in overseas assets more easily. This new openness combined with growing fears of a sharper than expected slowdown in Chinese growth is propelling Chinese investors to push forward asset diversification more aggressively than ever before.

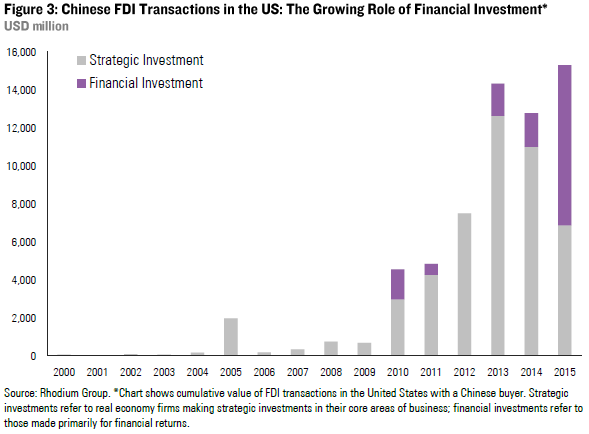

Several trends – such as the surge in Chinese OFDI in real estate, or the recent jump in OFDI by financial investors (insurance companies, private equity firms, etc.) suggest that a significant portion of FDI outflows is driven by safe haven portfolio diversification and other financial considerations, rather than traditional FDI motivations (strategic real economy investments). In the US for example, FDI by financial investors has jumped from virtually zero to more than $8 billion in 2015 (Figure 3). Most of it is coming from insurance companies and similar financial players (Fosun or Anbang), and a big share of it is going into commercial real estate and similar safe haven assets.

Short Term sentiment and Intra-company Debt

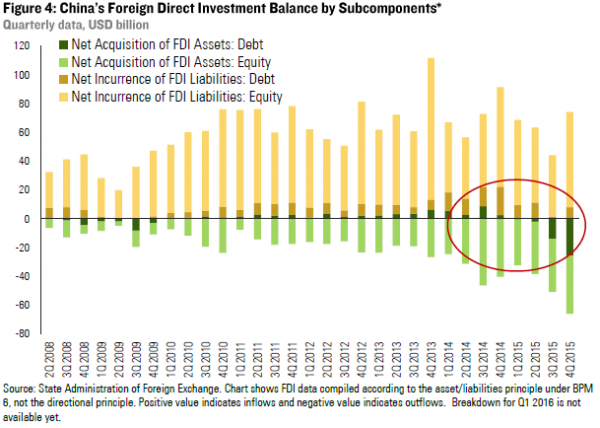

Another dimension of FDI that is important for explaining the recent swing in China’s FDI patterns is intra-company debt. In addition to equity investment, FDI statistics also capture transfers and debt holdings between parent companies and subsidiaries. A more detailed breakdown of China’s BOP data on those debt holdings (Figure 4) shows that dynamics in the debt portion of the FDI channel are partially responsible for the latest swing in China’s overall FDI balance.

From 2011 through the end of 2014, foreign companies in China and Chinese companies with overseas subsidiaries have both used intra-company transfers and debt to channel capital into China. In 2013 and 2014, firms have on average moved $15 billion into China every quarter, or around $60 billion per year.

In 2015 these patterns started to reverse as both foreign-invested firms in China as well as Chinese companies started to reduce foreign currency debt liabilities to their parents and overseas subsidiaries. By 4Q 2015, the $15 billion surplus in previous quarters had turned into a deficit of almost $20 billion. In other words, the dynamics observed in other categories of the financial account – Chinese companies and foreign affiliates operating in China reducing CNY holdings and paying off USD liabilities – are also impacting flows in the FDI channel.

Outlook and implications

While Q2 data may show a partial slowdown in net outflows under the FDI channel and perhaps even a return to a modest surplus, China’s FDI balance is unlikely to return to previous patterns. The end of the one-way CNY carry trade, declining competitiveness in low-end manufacturing, unresolved structural problems and political impediments will keep inward FDI flows at a lower level for the foreseeable future. The secular OFDI growth story on the other hand is hard wired and poised to continue for at least another decade, given China’s development stage and the low base that China is starting from. China’s leaders themselves expect an additional $1 trillion of OFDI outflows between 2015 and 2020, or $200 billion annually. In short, China has arrived in an era of new FDI realities: the enormous FDI surplus of the past decades cannot be taken for granted any longer, and there is significant risk for the deficit to worsen further.

It is not unusual for a country at China’s development stage to move to an FDI deficit after a period of structural surplus. However, the recent swing in FDI patterns is becoming a major concern for Chinese policymakers.

For one, FDI can be seen as a critical measure for the confidence of market participants in a country’s long-term growth outlook. An extended drop in inward FDI levels would be interpreted as foreign investors “voting with their feet”, adding to other data points suggesting a loss of confidence in China’s ability to sustain long-term economic growth. Chinese officials have become very eager recently to stress at every occasion that FDI levels are “basically stable”, fighting the notion of declining confidence of foreign investors. The FDI numbers seen in past quarters are not supporting that story.

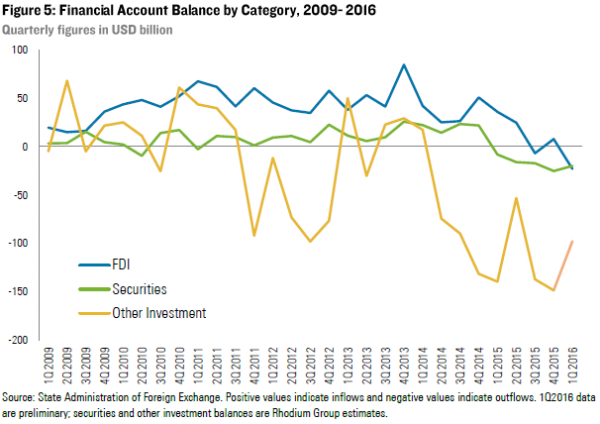

Second, the swing in the FDI account further increases pressure on China’s central bank with regard to exchange rate policy. It is correct that a significant portion of the FDI stock in China is illiquid and therefore not at risk of being moved out. However, as illustrated above, a significant portion of FDI flows is driven by shorter term considerations, and the recent change in quarterly net flows from a $40 billion surplus to a $23 billion deficit is significant. Until mid-2015, China’s financial account deficit could be largely attributed to wild swings in the “Other Investment” account. Now all three types of capital flows counted under the financial account are in deficit, increasing the costs of maintaining a stable exchange rate (Figure 5).

This has several implications for China’s behavior going forward:

First, Beijing will continue to closely monitor outflows through the FDI channel. We do not expect regulators to crack down on legitimate outbound investments on a large scale because China recognizes the value of OFDI for the long-term competitiveness of Chinese firms and the damage that backtracking on OFDI liberalism would do to the (already problematic) reputation of Chinese companies in global M&A markets and China’s commitments to the International Monetary Fund to move forward on external financial liberalization. However, we can expect continued informal “window guidance” for banks on foreign exchange access for outbound investors, which we have already witnessed in recent months. It is also possible that regulators will scrutinize investments with a financial rather than strategic character more diligently, especially in quarters with high capital outflows through other channels. This means that the existing uncertainty in the market about the ability of Chinese companies to successfully finance and close global M&A transactions will likely prevail.

Second, Beijing will be forced to work harder to encourage inward FDI flows: the swing in China’s FDI balance also highlights the urgency of implementing reforms for reversing current patterns of capital outflows. Recent FDI patterns confirm that external liberalization has already reached a point where selective enforcement of capital controls won’t change the deficit materially. China would have to implement very aggressive steps to meaningfully change FDI patterns through administrative measures, which is difficult to imagine. The most promising way to meaningfully change the negative psychology is to implement fundamental reforms that restore confidence in growth and create a more level playing field for foreign investors in China. Accelerating the implementation of FDI reforms that China has already committed to, for example, a national negative list for foreign investment, and the opening up of new sectors to foreign investment would be a meaningful step towards that goal.