Local Government Debt: Running Faster Just to Stand Still

Even if a substantial proportion of debt is refinanced, further defaults are inevitable and Local Government Financing Vehicles (LGFV) debt will continue to drag down growth in the coming years.

Despite monetary easing and an emerging recovery, Beijing will struggle to manage the financial stress produced by local government debt this year. Local Government Financing Vehicles (LGFV) bonds have regained investors’ trust and have been bid heavily early in 2019, but our analysis of financial statements from 2,489 LGFVs indicate that their aggregate debt—estimated from 41.2 to 51.7 trillion yuan ($6.1-7.6 trillion)—remains a key threat to local fiscal sustainability and a headwind to current cyclical momentum. Beijing will need to reduce interest rates to give localities time to raise revenue and pay down liabilities. Even if a substantial proportion of debt is refinanced, further defaults are inevitable and LGFV debt will continue to drag down growth in the coming years.

After China’s economy turned the corner in Q1, one of the key risks to the recovery extending is a pullback in policy support, particularly if the People’s Bank of China (PBOC) grows concerned about inflation. The potential for a hawkish turn from the PBOC is a risk worth watching, but the case for the PBOC remaining on an easing course is much stronger, particularly following renewed economic uncertainties surrounding the intensifying trade dispute with the United States.

The key reason the PBOC will need to keep reducing interest rates and maintain accommodative monetary conditions is the still-growing pressure from local government debt, particularly from local government financing vehicles (LGFVs). These entities are facing growing risks of default despite State Council measures last year to permit debt renegotiations and extensions. In around one-third of provinces, interest on LGFV debt is absorbing over 20% of new annual credit, even following the credit rebound in Q1 2019. Over 70% of the proceeds of new LGFV bonds are not funding new investment, but are instead refinancing old debt.

Credit growth has accelerated this year, but provincial credit data from the PBOC released earlier this week shows that Q1 lending was still concentrated in more dynamic coastal provinces, and many highly indebted interior provinces have been left behind. The PBOC will need to keep both eyes on managing financial system stress, and the bank cannot tighten monetary conditions for any significant amount of time.

LGFV bonds: The struggle to refinance old debt

We have long argued that the rate of credit growth in China’s financial system overall, and the rate of borrowing among quasi-fiscal local government vehicles in particular, has been unsustainable. Most of China’s debt is held by state-owned corporates and local government-linked companies, and therefore interest rates on this debt are higher than on government bonds. Credit growth will eventually be unable to keep up with the interest and repayment pressures from the mushrooming stock of outstanding debt.

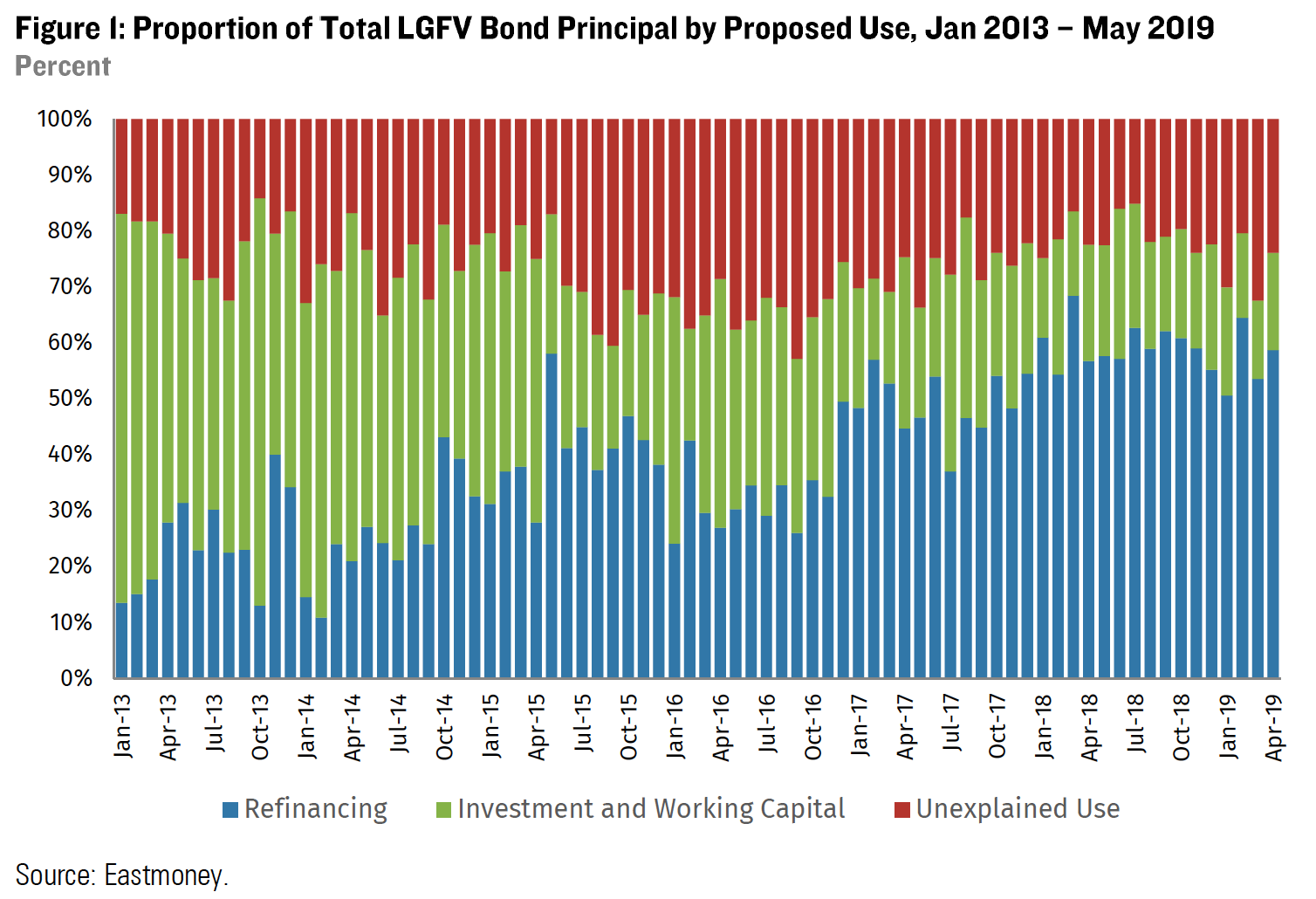

We conducted a bottom-up, comprehensive analysis of data from bond prospectus documents of 2,489 LGFVs. The results show the degree of stress that managing existing debt is placing on LGFVs and their associated local governments. A substantial proportion of new credit is only helping to keep LGFVs afloat, rather than funding new investment (Figure 1). While this note focuses on LGFV debt, a similar dynamic is likely occurring among many corporates, a key factor supporting our view that the current economic rebound is still vulnerable to credit events, and that the PBOC will have little room to tighten monetary conditions over the medium term.

Figure 1 below depicts data collected from Eastmoney, a financial information provider, concerning the volume and proposed use of funds from bonds issued by LGFVs, the primary off-balance sheet platforms that local governments use to fund infrastructure investment and other public spending. Breaking down bond issuance by usage is valuable to gauge the availability of financing for off-balance sheet government investment: LGFVs issue bonds not only to fund infrastructure but to pay down their own non-bond debt as well as the debt of other non-LGFV, local government-linked firms, and local state-owned enterprises.

In Q1 2019, 78.7% of LGFV bonds were used to repay or refinance maturing debt (the blue series) or to swap for other debt instruments, up from just 19.3% in 2013. The majority of bonds with “unexplained use” (the red series) are likely for some sort of refinancing purpose as well. The proportion of the unexplained category has shrunk while the proportion of bond proceeds explicitly used for refinancing has increased.

The chart below also clearly shows that over the past six years, the proportion of overall LGFV bond funds used for non-refinancing purposes, such as supplementing working capital and spending on projects like highways, high-speed rail, and utility construction, has declined steadily from over 80.6% in Q1 2013 to 21.3% in Q1 this year. Even though LGFV bond issuance is expanding, most LGFV borrowing is used to service old debt, so there is still less money left to fund new investment. We project that LGFVs will only raise 105.6 billion yuan in new investment funds from bonds compared to last year, amounting to only 0.11% of estimated 2019 GDP.

The central government has relaxed its stance towards LGFVs and is developing alternative means of refinancing, as discussed below, but these measures are designed to prevent widespread defaults rather than encouraging new borrowing. While local government special revenue bonds (SRBs), a key channel of fiscal policy support, will help to maintain infrastructure spending at a reasonable level, the impact of an increase in special revenue bond issuance from 1.35 trillion yuan in 2018 to 2.15 trillion yuan in 2019 is relatively minor. In contrast, LGFVs have an estimated total of 3.2 trillion yuan in interest alone due every year on their explicit interest-bearing debt, without even considering the principal of loans or bonds that are maturing.

Debt burden keeps gobbling up new credit

The need to refinance implicit local government debt will continue to weigh on local government investment activity in the medium term. Our review of LGFV financial reports, however, shows that the impact of this debt burden spreads well beyond the government sector. By itself, the interest on the implicit debt is currently absorbing 15.2% of total credit created over the past four quarters, depriving small and private companies of much-needed funding, and even impacting other state firms’ access to finance as well.

Our calculations of LGFVs’ debt and interest burdens are based on the 2018 annual reports from 2,489 LGFVs with bonds listed among the Shenzhen and Shanghai stock exchange and interbank markets. We found that LGFVs had accrued a total of at least 41.2 trillion yuan in outstanding interest-bearing debt at the end of 2018, with a higher-range estimate of 51.4 trillion yuan, or 57.1% of 2018 GDP.[1] Most of this debt has been used for public works and infrastructure projects, which by their nature produce very weak operating cash flows, meaning that LGFVs cannot support themselves without local government guarantees and financing.

In the first half of 2018, overall credit conditions and lending to LGFVs were weak, as the deleveraging campaign restricted shadow banking channels frequently used by LGFVs and property developers. Full-year 2018 reports show that these conditions appear to have improved marginally. We are careful in making exact comparisons between these reporting periods because the number of companies issuing reports can and does change as some LGFVs withdraw from the bond market, others enter, and some simply do not report mid-year numbers.

See Aug 2018: “Credit Risk Shifts to LGFVs”

Nevertheless, there does appear to have been a very modest decline in the interest burden compared to new credit over 2H, which is consistent with improving credit conditions. Monetary easing throughout 2018 and a boom in local government special revenue bond (SRB) issuance in Q3 helped to cut the annual interest on LGFV debt from 15.8% to 15.2% of TSF from June to end-year 2018. Although credit growth has picked up, LGFV debt is still a serious burden on the entire financial system.

Over the past six months, sources of local government revenue have been weakening. The National People’s Congress this year targeted 2.1 trillion yuan in cuts to taxes and government fees. Meanwhile, funding pressure and weaker housing sales have caused property developers to cut land purchases, down 33.1% by value in Q1. Given the lag between land transactions and developers’ payments to local governments, this drop will likely hit localities’ revenues over the next six months. Land sales make up about 90% of localities’ off-budget revenue, which is their primary means of funding LGFVs.

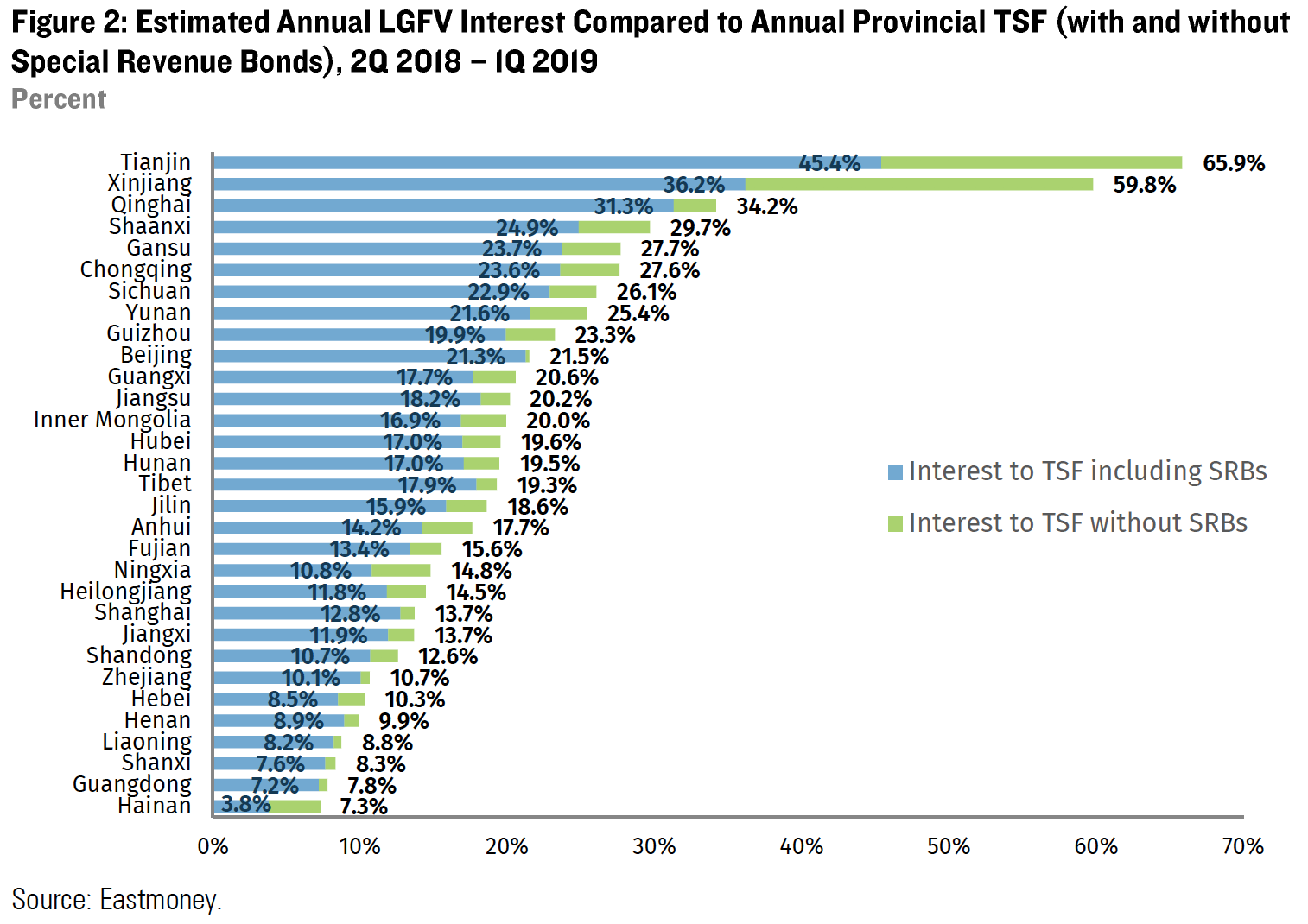

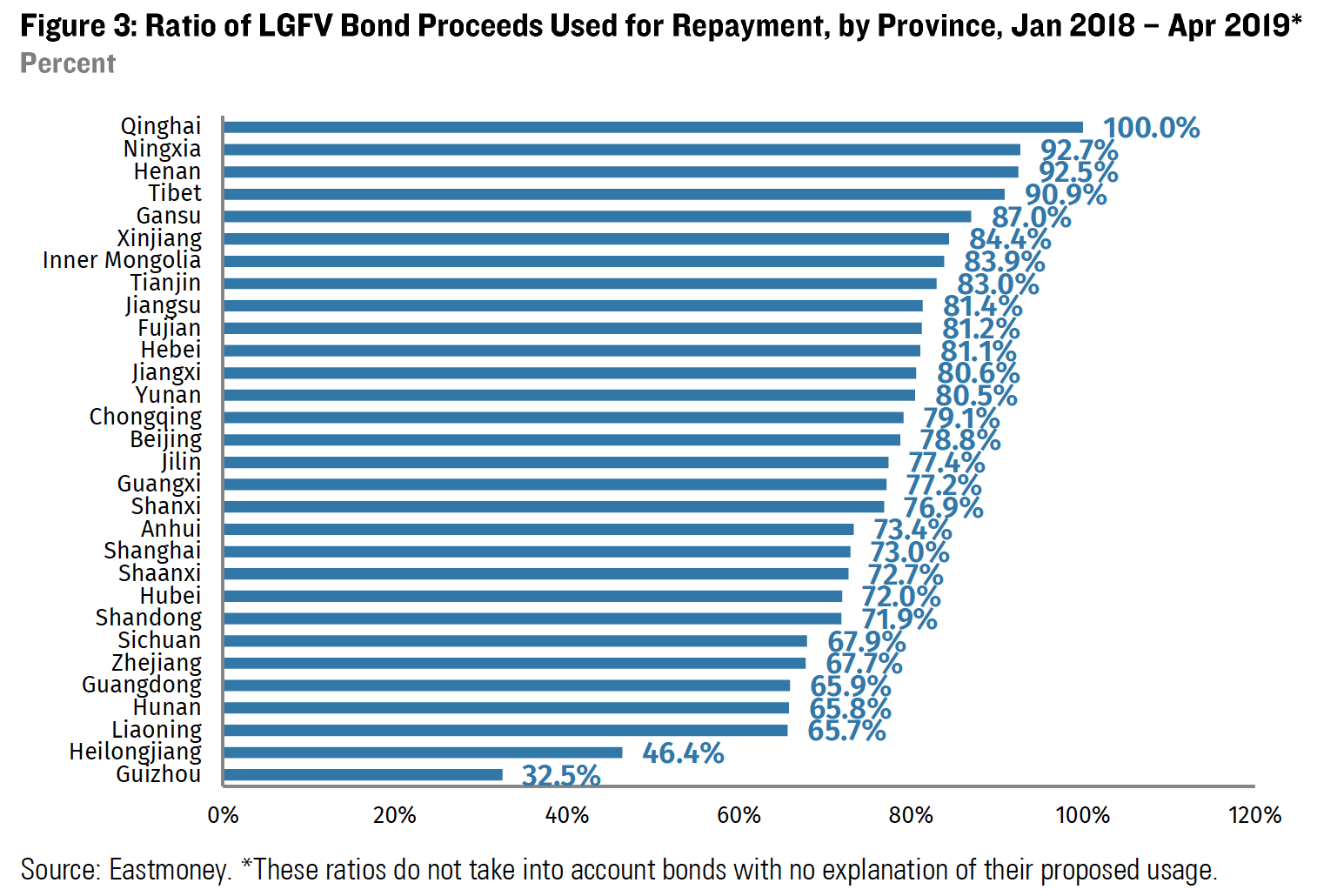

Credit risk will be concentrated in provinces and cities that are suffering from slower credit growth and localities that have relied disproportionately on quasi-fiscal spending to support growth. To identify where credit risk is most likely to emerge, we rely on two provincial data series: interest to TSF (Figure 2, above) and the proportion of LGFV bond issuance used for refinancing (Figure 3). The former series shows that interest on LGFV debt is absorbing over 20% of annual TSF in over one-third of China’s provinces.

LGFVs in Tianjin and Xinjiang, two of the most underwater provinces, enjoyed substantial relief as the result of special revenue bonds which fund off-budget governmental infrastructure projects, freeing up space on LGFV balance sheets. In 1H 2018, we observed that over 100% of Tianjin’s TSF was needed to repay interest on LGFV debt; it is likely that central authorities approved large volumes of SRBs for these regions to ward off credit events.

Figure 3 shows that almost two-thirds of provinces were using over 75% of the proceeds from LGFV bond issuance simply to refinance existing debt. It is unsurprising that provinces reporting cases of LGFV defaults are at the top of both of these tables. In Qinghai, for instance, where a local LGFV recently defaulted on an offshore US dollar bond, all new LGFV bond funds for the province are used to refinance old debt. Tianjin, another notorious source of LGFV spending and defaults (see our Tianjin data cited in the New York Times here), allocated 83% of its bond proceeds for repayment of various debts.

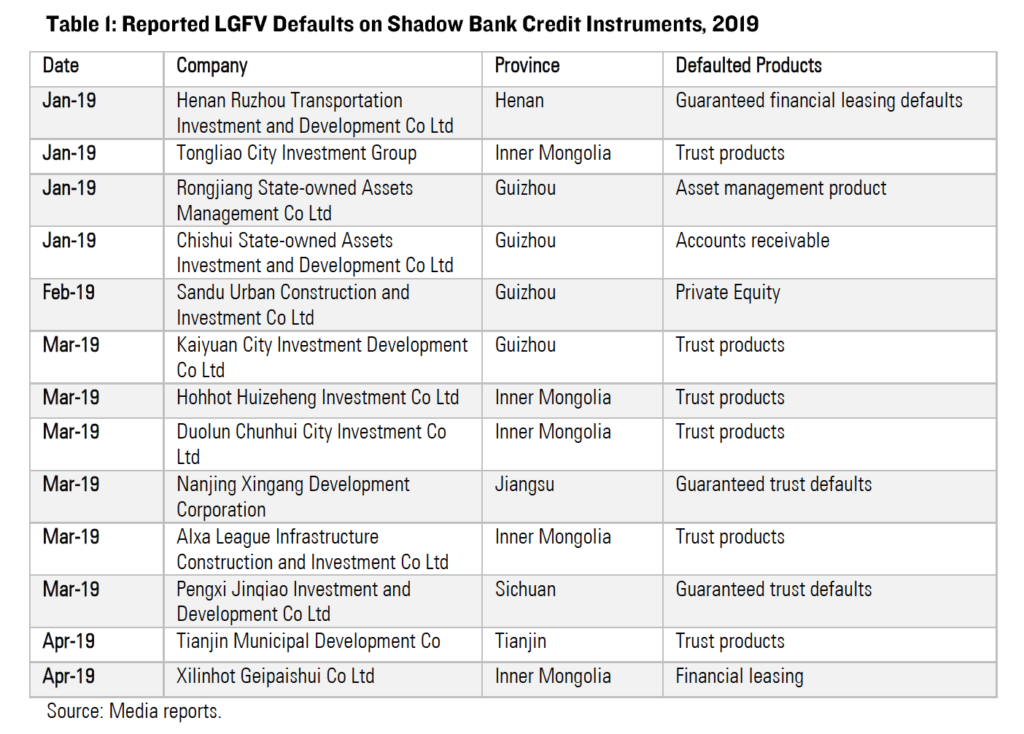

We have counted 13 cases of defaults on shadow banking instruments by LGFVs in the first four months of this year (Table 1), compared to 23 cases for the full year 2018. Since most shadow banking is private borrowing, the disclosure of information will be very limited. It is likely that these cases reported in the media are just the tip of the iceberg.

Sisyphus had it easy

Beijing clearly recognizes that implicit local government debt at current levels is unsustainable, and new measures have been introduced to refinance and restructure debt at lower interest rates, in order to prevent defaults and the resulting financial instability. So far the primary policy instruments—bond swaps and policy bank loans—have been underwhelming, and as a result, more defaults should be expected in 2019. We expect greater use of these tools over the next several years as policymakers work out a more organized restructuring plan.

However, refinancing support for LGFVs is fundamentally an interim measure that creates perverse incentives to add more debt. Over the long term, authorities will need to explicitly delineate the liabilities of local governments and the central government, which will inevitably involve defaults because localities cannot service most debts on their own. In the first half of 2018, Chinese authorities took decisive steps to restrict government guarantees of these vehicles and force localities to pay down implicit debt, which was one reason infrastructure investment slowed sharply last year. The change in policy caused lenders to back away from extending credit to quasi-government entities.

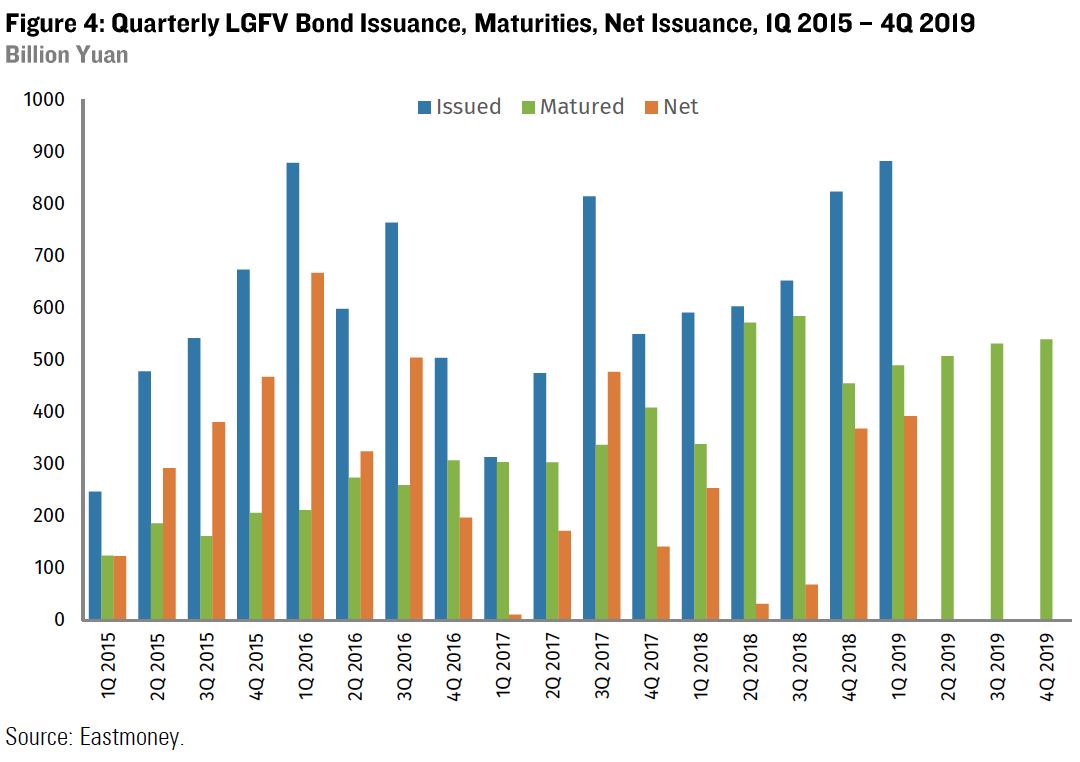

Policymakers became seriously concerned late in 2018 that infrastructure projects were being abandoned, and an October State Council circular permitted local governments to extend and renegotiate implicit debt. This signal and subsequent measures boosted demand for LGFV bonds, causing issuance to rebound in the last two quarters (Figure 4).

Since then, Premier Li Keqiang signalled in his work report at the National People’s Congress that the program used since 2015 to swap non-standard government debt for lower-interest local government bonds will continue, even though the quota under this program has almost been filled. By extending the program, authorities are admitting that MOF estimates of local government debt (18.4 trillion yuan at the end of 2018) are too low, and that much more debt needs to be refinanced and recognized on government balance sheets. Swap bonds issued in the first quarter were slightly over 100 billion yuan, and we expect an upper bound of 500 billion yuan in issuance in 2019, far smaller than the average of 3.75 trillion yuan in swap bonds issued over the past four years.

Ultimately, the swap bond program just refinances debt at a lower interest rate: it is still a local government liability that localities will struggle to repay. Monetization is the only realistic means by which the government can refinance these liabilities. It appears that authorities are now planning to channel central bank funds through the China Development Bank (CDB) for this purpose. LGFV issuers in smaller cities with weak fiscal conditions such as Zhenjiang, Xiangtan and Bijie have reportedly already received low-cost CDB loans this year. These loans both provide cheaper funding and also convey strong government support for LGFVs in these localities, allowing more bond issuance.

The volume of CDB loans to LGFVs this year is unknown, but the PBOC’s Pledged Supplementary Lending facility (PSL), the key source for CDB funding, has only increased by 161.5 billion yuan so far this year. As a result, support via this channel is likely relatively small compared to the debt burden facing localities, and probably will not exceed one trillion yuan in 2019. Both the swap bond program extension and CDB loans may have eased credit stress, but we still expect more credit events from LGFVs this year, most likely within shadow banking credit instruments and loans.

LGFV bonds: The honey amidst the poison

The fundamentals and the financial conditions of LGFVs are currently deteriorating and defaults among many types of liabilities are starting to pile up. But the pricing of LGFV debt within China’s financial markets is understandably more sensitive to government policy, rather than LGFVs’ operating performance. The signals of a fundamental policy shift from regulatory tightening to monetary easing and fiscal support for the economy have drawn LGFV bond investors back to the market, and LGFVs have enjoyed greater access to cheaper bond financing as a result.

For most of the 15-year history of LGFV bonds, investors assumed that they were essentially guaranteed by regional governments, but the deleveraging campaign and the specific restrictions on LGFVs shook this faith. Policymakers were alarmed by the swiftness with which investors and financial institutions cut off funding to local investment vehicles. Their primary goal since Q3 2018 has been to shore up public confidence in these vehicles.

With weak local government revenue and slow credit growth, authorities have been forced to triage financial resources. They have dedicated scarce funds to ensure the repayment of LGFV bonds because they are publicly traded and defaults on these bonds will impact market sentiment and refinancing capacity for an entire local government. But in supporting bond repayments, LGFVs will be forced to withhold support for other non-standard credit products (and for the banks and NBFIs that hold these assets). These defaults on informal credit instruments have not yet impacted LGFV bond issuance, but they do affect the secondary market yield of individual bonds.

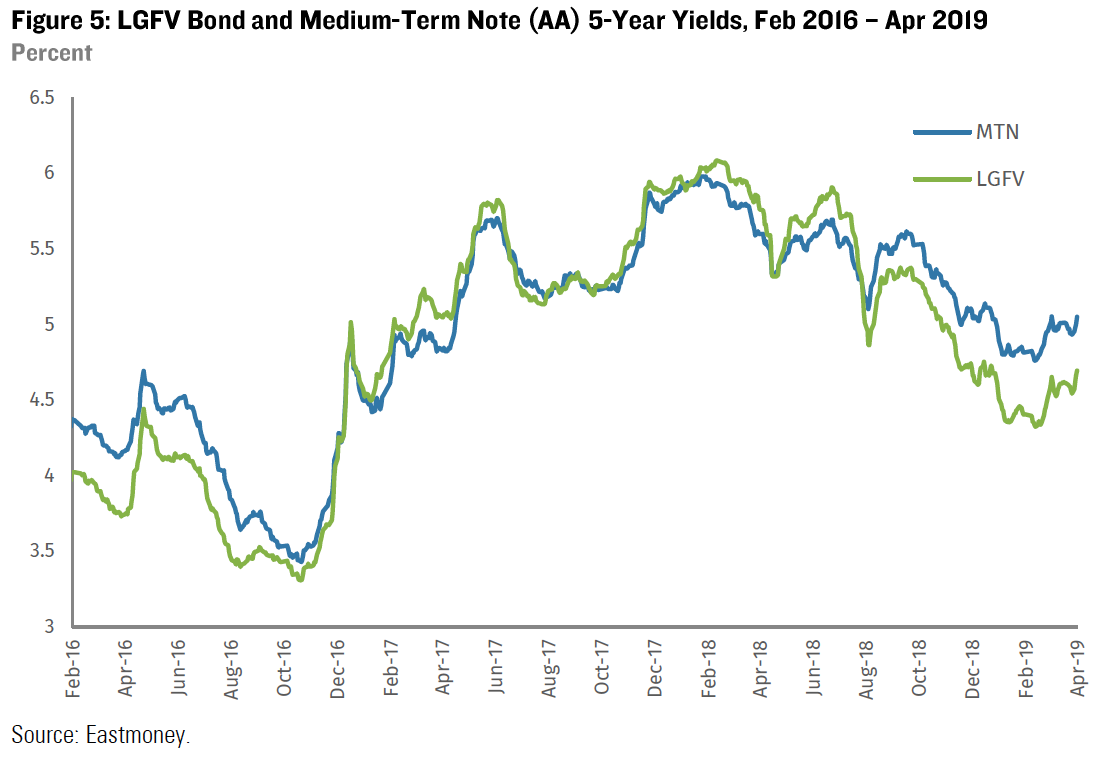

Overall, the average yield on LGFV bonds dropped by 140 basis points from mid-2018 to May 2019 (Figure 5). Outstanding LGFV bonds totaled about 9.1 trillion yuan as of April, a healthy increase of 10.5% y/y. These trends reflect the extent to which moral hazard is alive and well in China’s financial system. Some investors are purposely chasing the higher yields on LGFV bonds from highly indebted regions, betting that these cities will be among the first to receive help from the central government.

LGFV Debt to limit spending, require rate cuts

Beijing’s approach to managing local debt over the past 18 months has been conflicted, reflecting the contradiction between Xi Jinping’s desire to limit systemic financial risk on the one hand and the Party’s preoccupation with economic stability on the other. But the leadership does appear committed to one principle: local governments will be required to repay debt on their own. This stance is necessary to discourage debt growth, and to prevent all local government explicit and implicit borrowing from doubling or tripling China’s formal government debt-to-GDP ratios in international statistics.

While the bond swap program and CDB loans will reduce the interest burden and extend the terms of short-term debt, the overall volume of debt is not shrinking and will continue to accrue interest. Our previous analysis shows that even if LGFVs receive preferential rates of 3% on their outstanding debt, about 930 platforms (holding about 45% of reported LGFV debt) will still face interest payments exceeding 100% of their earnings. Localities simply cannot afford to support LGFVs at their current scale and will eventually need to cut off many from implicit government support, allowing them to either default or to become private firms. In the long term, the only sustainable solutions involve reform of the tax system or sales of local government assets.

In the short term, the high local government interest burden will continue to absorb significant portions of economy-wide credit even when considering quasi-fiscal policy tools like special revenue bonds. Until LGFV debt is restructured, these platform companies and their local governments will have little room to finance infrastructure and other new investment, especially compared to previous cycles.

To ensure that financial stress does not accelerate, the PBOC will be required to ease monetary policy and guide interest rates lower over time: this is a bare minimum to mollify financial market pressures as local government credit events emerge. The heavy debt and interest burden mean there is no room for any sustained rise in short-term interest rates, which might impact bond refinancing for LGFVs. As a result, any concern about PBOC hawkishness in response to rising inflation or renewed froth in the equity market should fade away quickly. Managing the local government debt mountain will remain a pressing concern for both the central bank and China’s leadership.

[1] To account for LGFVs without listed bonds, we adopt estimates from the work of Bai, Hsieh, and Song, who have estimated that debt accrued by non-issuing firms amounts to about 25% of debt listed on platforms. Bai, Hsieh, and Song, “The Long Shadow of Fiscal Expansion.” National Bureau of Economic Research Working Paper 22801 (2016). Our subsequent interest to TSF calculations rely on this augmented estimate.