Opportunities for Advancing Industrial Carbon Capture

The section 45Q carbon capture tax credit is set to expire at the end of 2023. This note assesses the technology deployment, emissions, and employment impacts of the credit.

Capturing carbon is one key technological decarbonization solution for the industrial and power sectors. Congress has sought to incentivize deployment of carbon capture technologies through a tax credit for carbon oxide sequestration (section 45Q of the Internal Revenue Code), set to expire at the end of 2023. This research note assesses the technology deployment, emissions, and employment impacts of the 45Q credit in the industrial sector under current policy. We also consider the impact of a hypothetical five-year extension and of making the credit permanent. We find that a five-year extension of 45Q could result in the deployment of as much as 144 million metric tons of capture capacity through 2035, and a permanent extension could deploy as much as 152 million metric tons of carbon capture capacity by 2050. A permanent extension can reduce CO2 emissions by 2.5 billion metric tons cumulatively on net through mid-century—4 to 5 times the impact of the current policy framework. Retrofitting these industrial facilities with carbon capture could also create up to 61,800 job-years through 2035.

The challenge: decarbonizing the industrial sector

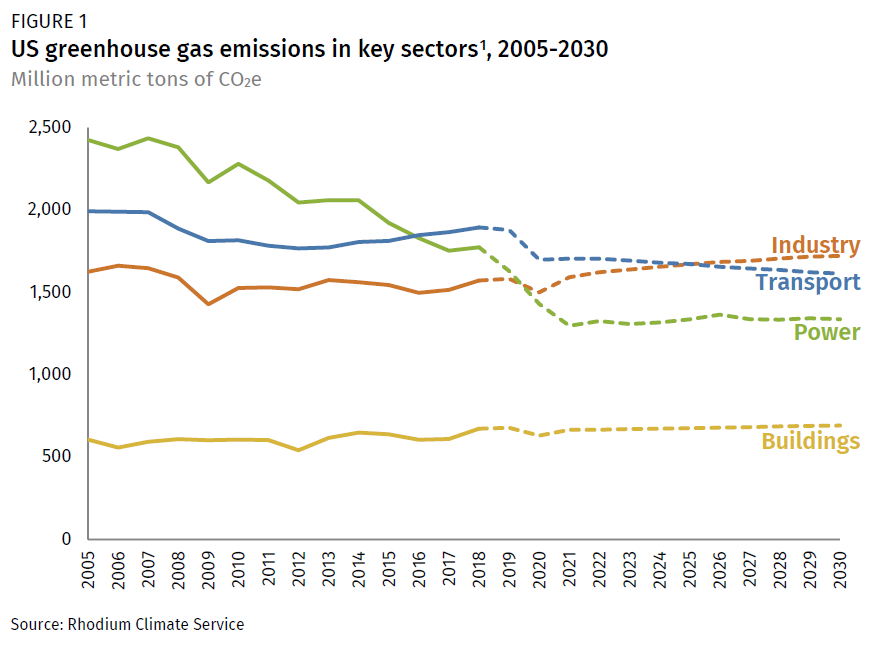

As we have noted previously, without additional policy the industrial sector is on track to become the highest-emitting sector of the economy in the mid-2020s under any post-COVID economic recovery pathway (Figure 1).[1] Due to state and federal policies already on the books combined with market forces such as cheap natural gas and renewables, power and transportation emissions are trending downward through 2030. Meanwhile, increasing demand pushes industrial emissions upward over this period. Unlike transportation and electric power, there are far fewer discussions around policy ideas that can mitigate this trend. Even economy-wide policies like a carbon price have a tough time achieving large emissions reductions because of the barriers to fuel-switching and difficulty turning over capital stock in the industrial sector.

The challenge in the industrial sector is a lack of economically competitive low-carbon technologies that can be applied across a range of diverse industrial applications. There are opportunities to electrify some industrial end uses, particularly lower-temperature heat, but this still leaves a large share of heating to be met by on-site combustion. Low-carbon replacement fuels like hydrogen or biofuels are more expensive than incumbent fuels like natural gas. Moreover, some CO2 emissions are byproducts of the chemical reactions used in industrial processes today. The production of cement requires calcination of limestone, which releases CO2 as part of the liming process. Likewise, iron ore interacts with carbon monoxide at high temperatures, producing molten iron and CO2 in the blast furnace method of steelmaking. Alternate production methods exist in the cement and steel industries that reduce or eliminate these process emissions, but they are still in early stages of development.

Since fossil fuels and carbon-intensive production processes are likely to continue to dominate the industrial sector in the near- to medium-term, capturing the resulting CO2 emissions at industrial facilities is critical to achieving decarbonization goals.

Carbon capture in the industrial sector

Not all CO2 emissions from industrial sources are created equal. Within industrial exhaust gas there’s a range of CO2 concentrations and the presence or absence of other pollutants. In some industries, particularly ethanol production, ammonia production, and natural gas processing, the industrial process itself yields a stream of relatively pure CO2. In these high-purity cases, the emissions stream can be compressed to produce pipeline-ready CO2. These streams don’t require any special capture technology to remove some or all of the CO2 from the production process. In other industries where the concentration of CO2 in exhaust gas is low, like cement production, petroleum refining, steelmaking, and hydrogen production, a post-combustion capture technology like an amine scrubber can be deployed to separate CO2 out of a waste gas stream. The use of these capture technologies results in a higher per-ton capture cost in these low-purity industries.[2] Still another set of industries may not be candidates for capture at all, given the economics of capture technologies, as the level of CO2 in exhaust streams approach atmospheric concentrations or the exhaust is loaded with contaminants such as sulfur. Once the CO2 is captured, it can be stored safely underground in secure geologic storage (typically saline basins) or sold for use (largely in enhanced oil recovery (EOR) operations, but also in small amounts for other purposes). If the CO2 is sold for use, the carbon capture developer receives revenue from these sales.

The US has been a global leader in carbon capture deployment. At the end of 2019, nine of 17 industrial carbon capture facilities operating globally were in the US. These facilities had an annual capture capacity of about 24 million metric tons. This leadership is poised to continue in the near term: the Clean Air Task Force has identified 16 facilities representing at least 19 million metric tons of capture capacity in some stage of development in the US. The Great Plains Institute and others have identified up to nearly 150 million metric million metric tons of capturable CO2 per year at industrial facilities based on near- and medium-term economics. These analyses incorporate the revenue from the 45Q tax credits to make carbon capture pencil out economically.

The bipartisan policy response: 45Q tax credit

The main policy that Congress has used to advance carbon capture deployment is the carbon oxide sequestration tax credit (section 45Q of the Internal Revenue Code). At its core, the 45Q credit provides a per-ton tax credit for CO2 that is captured and stored or used for qualified purposes. The credit applies to CO2 captured both at industrial facilities and power plants, but we will cover power sector carbon capture in a forthcoming note. The credit was initially enacted in 2008, but in 2017 a bipartisan group of Senators introduced the FUTURE Act to strengthen it. This legislative language was eventually incorporated into the Bipartisan Budget Act of 2018, which President Trump signed into law in February 2018.

The 2018 revision made three main changes to the credit. First, it increased the size of the tax credit, ultimately to $50 per metric ton of CO2 that is captured and stored or $35 per ton that is used for EOR or other qualified uses.[3] Second, the revision expanded the qualified uses of captured CO2 beyond EOR and also explicitly included direct air capture (DAC). Third, the credit shifted from a 75 million metric ton cap to a 12-year payout. The 2018 revision also added a deadline: to qualify for the credit, a facility had to commence construction by the end of 2023. Subsequent guidance from the Internal Revenue Service (IRS) also set a six-year deadline for construction of qualifying facilities.

Despite Congress enacting these revisions in early 2018, it took the Internal Revenue Service more than two years to release proposed regulations implementing these changes. This lack of regulatory certainty led to a slowdown in carbon capture deployment as developers awaited further information about how they can qualify for the credit. As a result, recent legislative proposals as well as a variety of groups have called for an extension of the commence construction deadline. In this note we consider two such proposals: a five-year extension and a permanent extension.

Carbon capture deployment and emissions under 45Q scenarios

To estimate the deployment of carbon capture retrofits at existing industrial facilities in the US, we used RHG-ICAP, a facility-level US industrial carbon capture model developed and maintained by Rhodium Group. RHG-ICAP considers different levels of optimism for the current and future cost of CO2 capture (characterized by “low costs” and “high costs” in this note) at existing facilities in seven key industrial categories.[4] The costs and performance data underpinning RHG-ICAP are informed by the latest literature.[5] The model calculates how much carbon capture will deploy under a given incentive policy, taking into account infrastructure deployment constraints as well as varying construction periods. Facilities can either take the geologic storage 45Q credit or, in select regions, the utilization 45Q credit along with revenue from sales of CO2 for EOR.

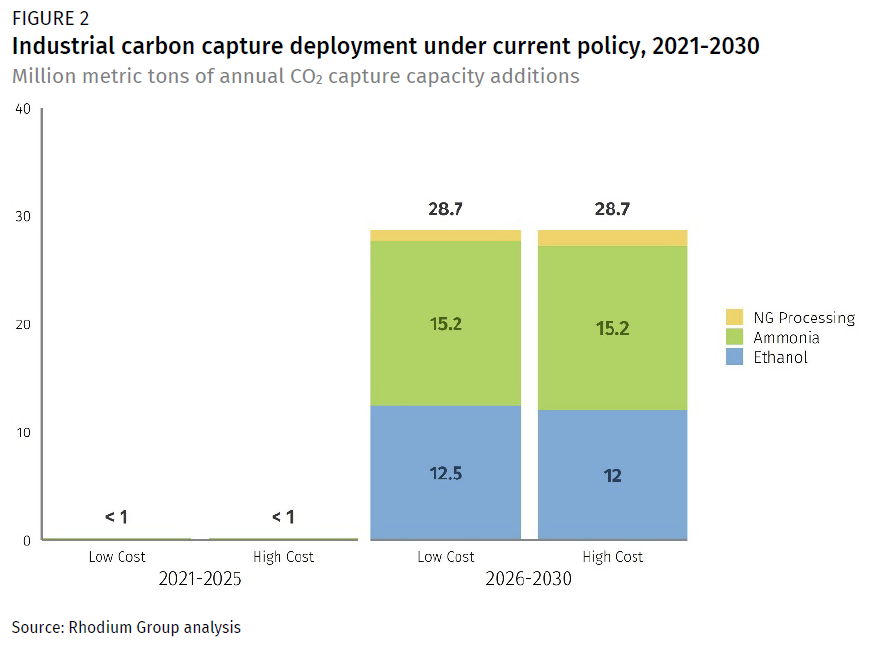

Under current policy, where 45Q expires at the end of 2023, we find that 29 million metric tons of capture capacity will be installed by the end of 2030 regardless of technology costs (Figure 2), but we find no additional retrofits after 2030. These retrofits are entirely on high-purity facilities, representing the cheapest and most straightforward opportunities (ethanol and ammonia production), plus a modest number of retrofits at natural gas processing facilities. Deployment of this magnitude is fairly consistent with the number of retrofits currently in the development pipeline. Similar to findings in previous research, we find that current 45Q incentive values are not sufficient on their own to spur additional direct air capture (DAC) deployment. This finding holds when considering possible extensions of the credit. Additional policy support will be required to accelerate DAC deployment.

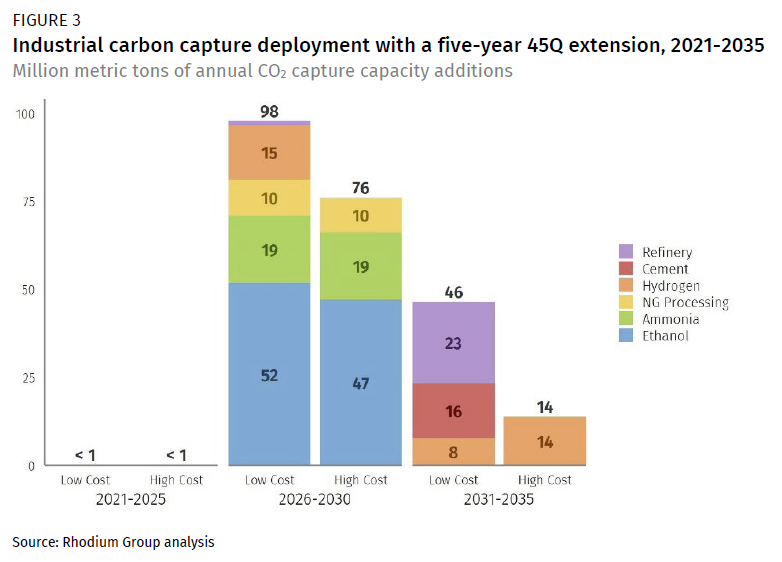

If Congress were to extend the 45Q commence construction deadline by five years through 2028, then substantially more carbon capture capacity will deploy compared to current policy. Continued support drives a total of 76 to 98 million metric tons of capture capacity through 2030 (Figure 3)—2.5 to 3 times more than current policy. Unlike current policy, deployment occurs post-2030 with a credit extension—leading to between 90 and 144 million metric tons of capture retrofits through 2035. We find that extending 45Q by five years leads not just to more projects but more diverse applications in hydrogen production, cement manufacturing, and petroleum refining facilities. As more facilities retrofit with carbon capture, technology costs drop through learning, amplifying the increase in deployment.

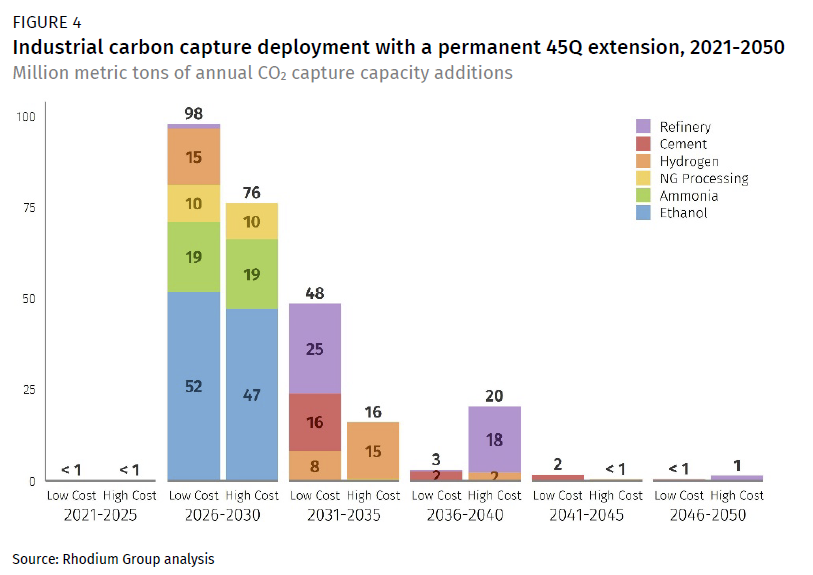

A permanent 45Q extension, as proposed by some members of Congress, will yield even more carbon capture retrofits than a five-year extension. The primary incremental impact is post-2035, and in total 114-152 million metric tons of capture capacity is deployed by 2050 (Figure 4). The majority of plants that come online in the 2030s and 2040s are economic with the EOR 45Q credit plus revenue from CO2 sales for EOR.[6] As CO2 revenues increase in later years, higher-cost retrofits (like refineries in the high-cost case) become economic, compounded by continued cost reductions through learning.

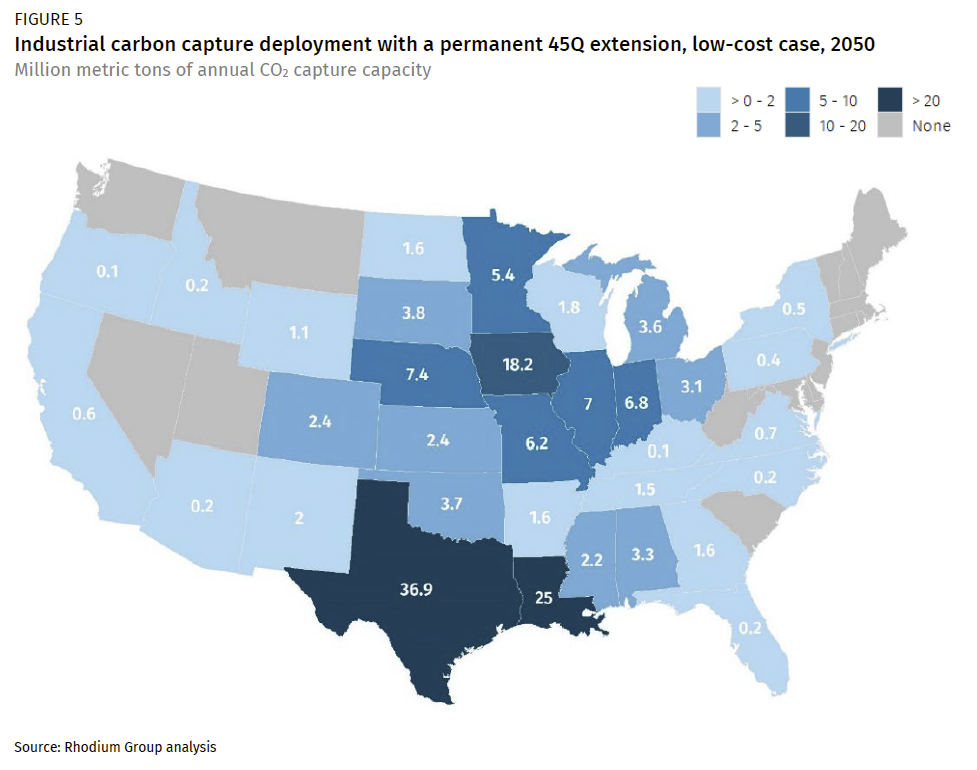

We find that a permanent 45Q extension catalyzes carbon capture deployment in 33 states. Texas and Louisiana lead the pack in carbon capture deployment. These states have the highest state-level industrial CO2 emissions in the country, accounting for nearly half of US industrial CO2 emissions. States with large ethanol industries also see substantial retrofits, most notably in the Midwest including Iowa, Nebraska, Minnesota, Illinois, and Indiana. Other industries, like cement manufacturing and ammonia production, are somewhat more geographically diverse.

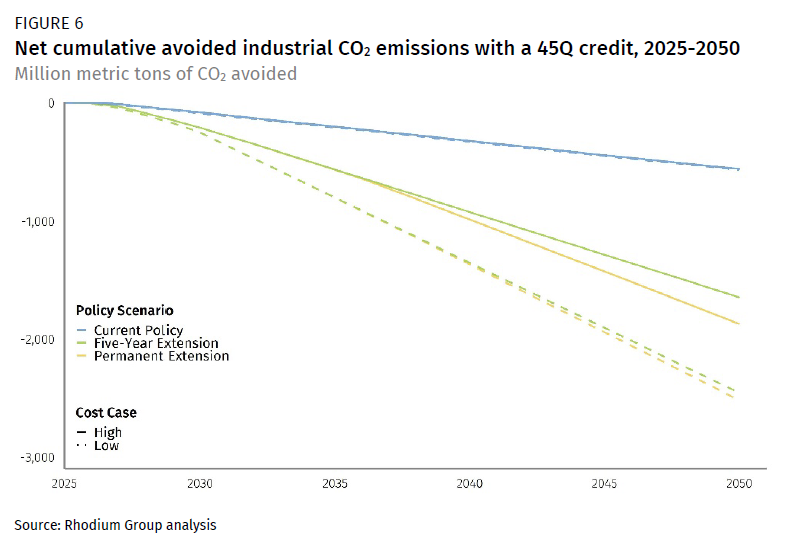

Capture capacity and avoided emissions from carbon capture aren’t the same thing due to utilization rates and the emissions associated with energy used in the capture process. Under current policy, deployed carbon capture will reduce CO2 emissions by 558-565 million metric tons of CO2 cumulatively through 2050 (Figure 6). If the 45Q credit is extended for five years, deployment of carbon capture could reduce CO2 emissions by a cumulative 1.6-2.4 billion metric tons through 2050. With a permanent extension of 45Q, the associated capture retrofits could reduce CO2 emissions by 1.9-2.5 billion metric tons cumulatively through 2050—4 to 5 times the impact of the current policy framework.[7]

Related employment impacts of 45Q deployment scenarios

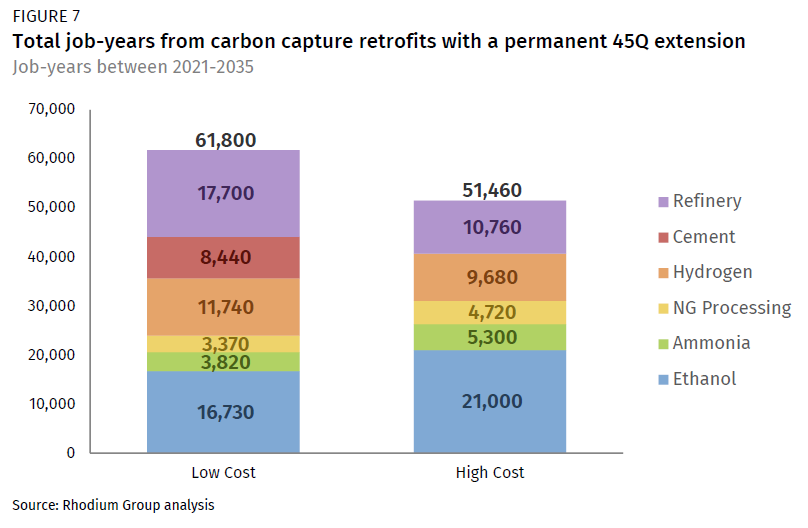

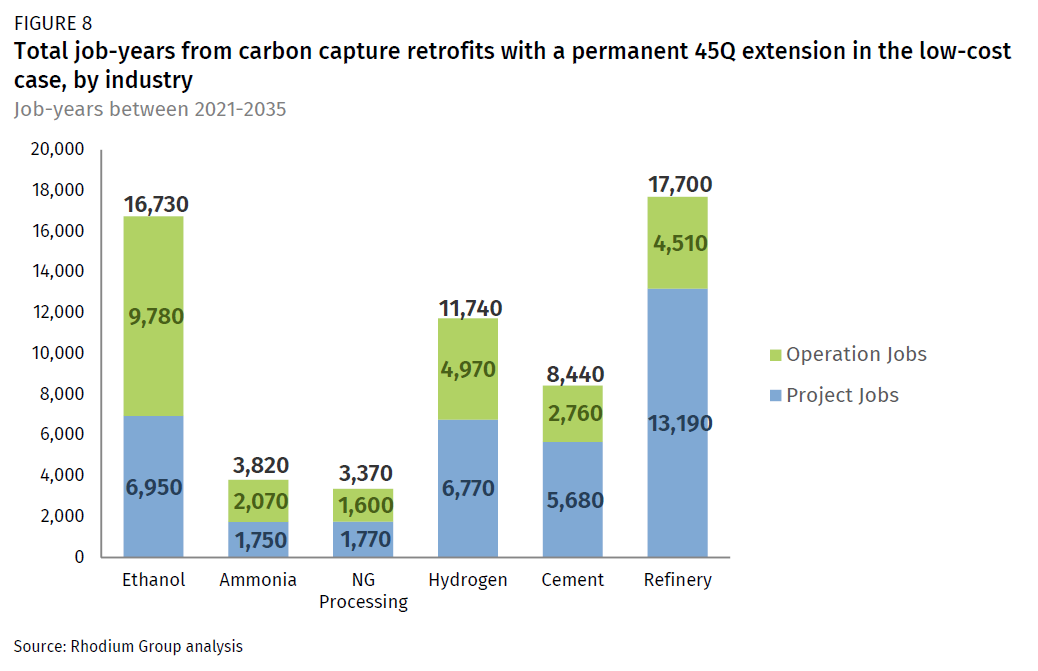

Catalyzing investments in carbon capture retrofits through 45Q will also create jobs. To quantify the employment impacts of our deployment scenarios, we use the IMPLAN economic model to translate our project development and operation costs into job-years.[8] Under a permanent extension of the 45Q credit, construction and operation of the associated carbon capture deployment creates 51,460 job-years through 2035 in our high cost case, and as many as 61,800 job-years in our low cost case (Figure 7). The share of jobs is generally aligned with total capture capacity deployed in each industry, though there is some variation. These are the jobs associated specifically with the carbon capture retrofits and do not include other jobs at these facilities.

We also examined the breakout of these jobs between project jobs associated with the design and construction of these facilities and jobs associated with day-to-day operations. In general, capital costs are lower at high-purity sources, so they tend to have a similar amount or more operation jobs than project jobs. The reverse is true for capital-heavy, low-purity sources, where more job-years are associated with the project development phase than the operational phase.

A key technology, a policy pathway

Retrofitting existing industrial facilities with carbon capture can play an important role in decarbonizing the industrial sector. Absent sustained policy support, we find that a relatively low level of capture retrofits are economically feasible. With a permanent extension of the 45Q tax credit, carbon capture retrofits could total more than 150 million metric tons of capture capacity by 2050—a significant increase from current policy. These retrofits are associated with meaningful cumulative emission reductions and create a substantial amount of jobs. While other policies, such as a carbon price, may incentivize a wider array of emissions abatement in the industrial sector, an extension of 45Q has the potential to further deploy carbon capture technology and maintain American leadership in this burgeoning space.

[1] Emissions from Rhodium Climate Service Taking Stock 2020 “V” scenario.

[2] Several other approaches to carbon capture are less commonly considered in the industrial sector, including pre-combustion capture and oxyfuel capture.

[3] Both credit values are indexed to inflation.

[4] These industries are ethanol production, ammonia production, natural gas processing, hydrogen production (both merchant and refinery), cement manufacturing, fluid catalytic cracking at petroleum refineries, and integrated steelmaking.

[5] In particular the National Petroleum Council’s Meeting the Dual Challenge: A Roadmap to At-Scale Deployment of Carbon Capture, Use, and Storage report and the National Energy Technology Laboratory’s Cost of Capturing CO2 from Industrial Sources report.

[6] RHG-ICAP focuses only on the current state of the art of carbon capture technology as it applies to select CO2 sources in seven industries. In the permanent extension scenario, the 45Q credit and CO2 revenue (where applicable) drive retrofits at about two-thirds of identified facilities. Advances in carbon capture research and development could result in substantially lower capture costs for other CO2 sources or industries, but such possibilities are outside the scope of this analysis.

[7] These figures assume carbon capture-retrofitted facilities remain operational beyond the 12-year 45Q payout. We assume other policies will provide the $7-29 per ton in ongoing O&M costs post-financial asset life.

[8] A job-year is the equivalent of one full-time job for the duration of one year. All values reflect jobs associated with all 45Q projects deployed under current policy and a permanent extension.

This nonpartisan, independent research was with support from ClearPath. The results presented in this report reflect the views of the authors and not necessarily those of the supporting organization.