City-Level Financial Stress Rising

Local-level credit events in China are piling up, and evidence of broader stress across China’s financial system is accumulating.

Local-level credit events in China are piling up, and evidence of broader stress across China’s financial system is accumulating. The ultimate cause is the contraction in shadow banking under the deleveraging campaign, as the informal financial system had previously kept highly indebted local governments afloat. The bill for the post-crisis credit expansion is now coming due, and recent defaults by some of Tianjin’s larger state-owned firms will not be the last credit events from China’s local governments.

In this note we take an in-depth look at city-level financial data, using disclosures from local government financing vehicle (LGFV) bond prospectus documents and city-level fiscal data. The analysis yields a large number of cities facing similar levels of pressure to Tianjin, particularly in China’s northeastern and southwestern regions. These credit events will limit the effectiveness of counter-cyclical stimulus measures in the coming years and will force Beijing to consider more aggressive options to clean up local debt.

To echo Tolstoy, all Chinese local government development models are alike, but each city facing local financial distress is different in its own way. The recent headlines concerning local government financial stress have been focused on the city of Tianjin, which saw a default on a dollar-denominated bond by the commodity trading firm Tewoo. As early as last April, Tianjin had already seen a default on an asset management product issued by its largest LGFV, Tianjin Urban Construction and Development. Tianjin has been an exceptional case in that the province-level municipality aggressively pursued construction of new districts funded via its LGFVs, and the contraction in shadow banking has caused an outsized credit squeeze for the city.

But Tianjin-type problems may be brewing in several other localities, particularly in cities in China’s northeastern and southwestern regions, and in other more developed areas such as Jiangsu province as well. Local governments’ ballooning implicit debt has become a major headache for policymakers and a primary target of Beijing’s deleveraging campaign. Localities’ perpetual demand for funding is understandable given the mismatch between city-level fiscal revenues and spending responsibilities. Infrastructure is also frequently used as an engine to spur growth, adding to localities’ debt burdens.

The new budget law that went into place in 2015 technically banned all local government borrowing outside of bonds. But this “front door” of bond financing was never sufficient to address localities’ financing needs, and shadow banking channels continued to expand until mid-2017, when the deleveraging campaign placed localities under a more severe credit crunch. In 2018, Beijing realized that implicit debt was too large to be sustainable and started another round of tightening against local government borrowing, through LGFVs and other affiliated SOEs, and even schools and hospitals.

Credit events have consequently been more frequent for local governments and their LGFVs starting last year, although most defaults have occurred among shadow banking instruments, rather than bond defaults. City and rural commercial banks are by far the most vulnerable to localities’ credit events as well, given the tightening of interbank funding conditions that has followed the default of Baoshang Bank (See Oct 2, “The Age of Capital for China’s Banks”).

In this note we go one step further to look at specific cities, their debt levels, local fiscal revenue conditions, economic growth, and bank loan levels to identify potential hotspots of financial distress. None of these individual cases of distress likely represent systemic threats. But collectively, local financial pressures will limit Beijing’s policy options and the overall effectiveness of counter-cyclical policies to support the economy. And as these credit events materialize, Beijing will also need to develop more comprehensive strategies to fiscalize local government debt, most likely through expansion of the fiscal deficit and the PBOC’s balance sheet.

The Heatmap: City-Level Financial Distress

One of the most important consequences of the deleveraging campaign has been a significant contraction in the shadow banking system across China. This squeeze on shadow financing has generated inequality in credit conditions across provinces, as interior provinces in the northwest, northeast, and southwest of China relied heavily upon informal financing channels to maintain infrastructure construction. This skew in provincial credit conditions was at its widest in 2018, when some provinces, such as Jiangsu and Guangdong, saw above-average credit expansions, while others such as Tianjin, Qinghai, Heilongjiang, and Jilin saw credit growth below 5%, according to PBOC data, which was probably insufficient to even pay for interest on aggregate debt throughout the province.

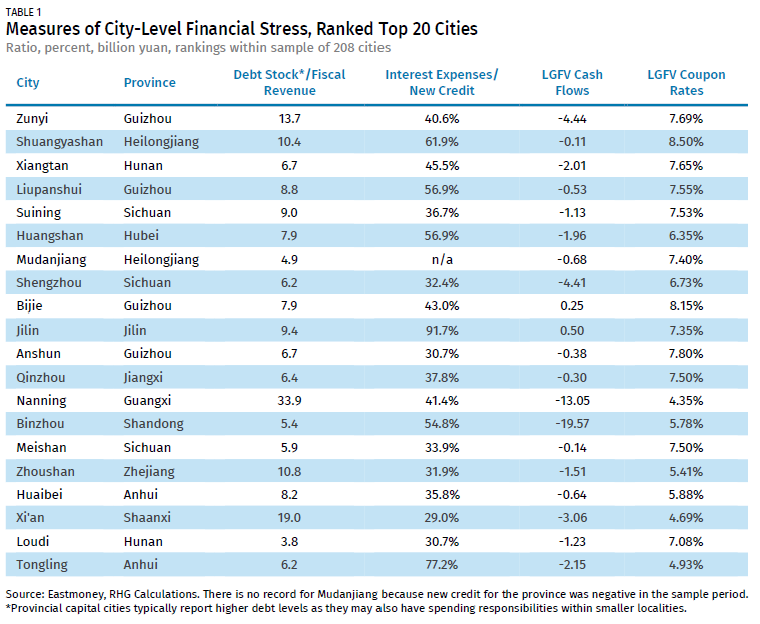

To calculate where this stress was most acute at the city level, we looked at data from LGFVs’ financial statements within 208 individual cities through the financial data portal Eastmoney. Then we ranked cities along several metrics (the four in the table below) and averaged the rankings across our sample of 208 cities. This is necessarily incomplete as the data used here are not comprehensive across all Chinese cities, and not all data series are complete across all of the cities surveyed, but it should capture some of the more intense pockets of financial distress nationwide, at least within our sample.

What stands out most clearly are the concentrations of city-level stress in the northeastern regions (Heilongjiang in particular) and the southwest, particularly in Guizhou. The average annual interest expense for LGFVs among these top 20 cities is 45.7% of all new annual bank loans within the city. The average coupon rate for LGFVs within this sample is 6.79%. The aggregate cash flow for most of these cities’ LGFVs is also negative, meaning that operating and investment cash outflows exceed inflows from financing. For cities facing this level of distress, more credit and more bond issuance is necessary but also insufficient. Restructuring and fiscalization of the debt will be necessary, along with transfers of responsibility for repayment from local to provincial or central authorities. Until that occurs, expect more credit events within banks in cities with these general characteristics.

Fiscal Revenues Pressured by Slowing Property Markets

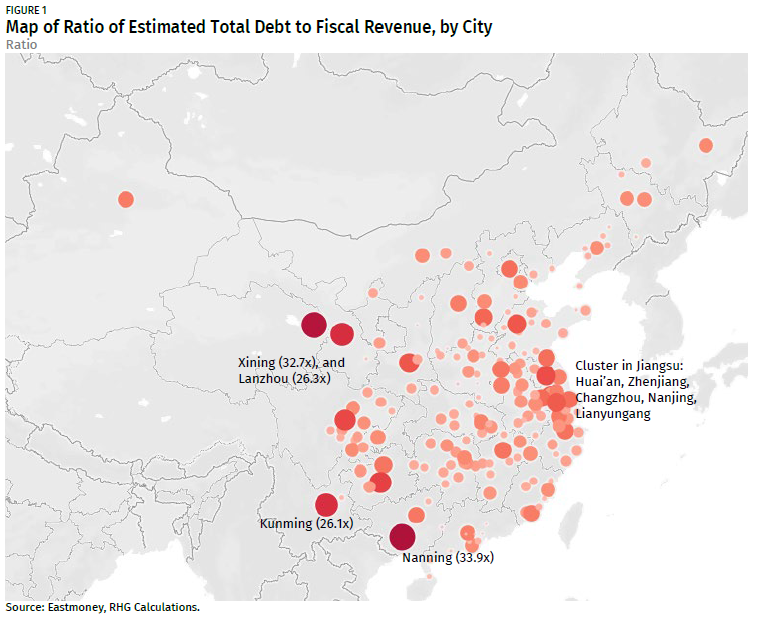

Besides the deleveraging campaign, another key source of pressure on city-level governments is the slowing property market, and weakening land sales. Localities depend heavily upon land sales for fiscal revenues, so that any slowdown in land sales can make large debt burdens far more difficult to service. The data used for Figure 1 below references LGFV debt totals by city as of June 2019 relative to fiscal revenue totals by city for the year 2017. The LGFV debt totals include outstanding interest-bearing debt plus non-interest-bearing short-term liabilities by LGFVs under a city’s jurisdiction, as a multiple of a locality’s annual fiscal intake.

While Tianjin has generated recent headlines, several other cities find themselves in far more precarious financial positions. Xining in Qinghai province, which already saw a local LGFV defaulting on dollar-denominated bonds, is high on the list, with many other cities in southwestern China reporting outstanding debt levels easily more than 10 times the local annual fiscal intake.

This stress will intensify if property market conditions deteriorate in 2020 and 2021. Beijing’s tightening policies against the property market are increasing localities’ difficulties in selling land as large developers reduced capital expenditures or turned to smaller competitors to acquire land banks rather than buying land at auction from local governments. Local government land sales revenue growth slowed to just 6.9% for the first 10 months of this year, compared with 25% for 2018 and 40.7% for 2017, while year-to-date land transactions fell outright by 16.3%, suggesting even weaker land revenue growth for localities in the future.

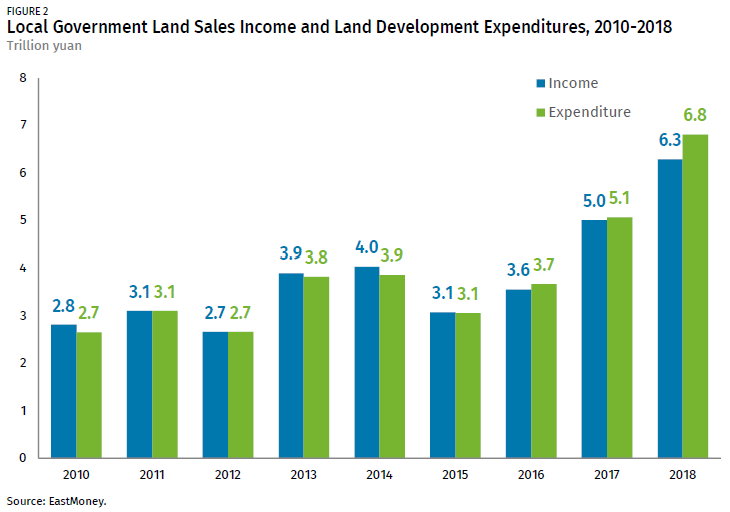

In the past, land sales revenue was a key external source of financing to fill the funding gap produced by rapid infrastructure construction. But as compensation costs of resettling residents rose alongside property prices, it is much more difficult for localities to actually earn money from land sales. Before 2016, the land business was still profitable, but after that year, local governments have been losing money from land development (Figure 2), which itself requires rising levels of local government special revenue bond (SRB) issuance to fill the gap.

Adding to the burden is Beijing’s shantytown redevelopment program. In the early years of this program, local governments built new houses to relocate residents, which added to already high housing inventories and produced a significant correction in the property market in 2014 and early 2015. To reduce these market imbalances, Beijing launched cash compensation for resettled residents to buy housing out of developers’ existing stock, funding the program via PBOC loans to the China Development Bank, and on to local governments. The move saved the property industry and reduced inventories in overbuilt cities, lifting property prices and encouraging speculation, but also left local governments with heavy debt burdens. The PBOC now has 3.6 trillion yuan in outstanding pledged supplementary lending (PSL), mostly lent to local governments through policy banks.

The shantytown redevelopment program will expire in 2020, which will remove a key source of demand for housing across China, particularly in smaller cities with high debt burdens. Land will be harder to sell for these local governments, and the possibility of a nationwide fall in property prices would only increase financial stress for localities and city and rural commercial banks.

Rising Funding Costs and Heavy Annual Interest Burdens

Local governments have been forced to rely upon external funding channels just to service the interest costs on an already heavy level of debt. But the cost of borrowing has been rising since the start of Beijing’s deleveraging campaign, which specifically targeted shadow banking channels and implicit borrowing by local governments. Most LGFVs do not generate cash flows themselves and rely heavily upon local government fiscal resources to repay interest and principal on existing debt. The deleveraging campaign has made these financing cash flows for LGFVs far more scarce and expensive.

Most local government implicit debt is held in the form of loans or shadow banking instruments, which generally are loans in other forms to bypass regulatory restrictions, and bear higher interest rates than bank loans. LGFV bonds have been a popular financing tool, but the nearly 10 trillion yuan in outstanding LGFV bonds only accounts for around one-fifth of LGFVs’ total interest-bearing debt, based on our bottom-up estimates from LGFVs’ financial statements. This structure of borrowing has significantly increased the financing costs for China’s localities, and the Ministry of Finance said at the end of 2015 that non-bond local government borrowing carried an average interest rate of 10%.

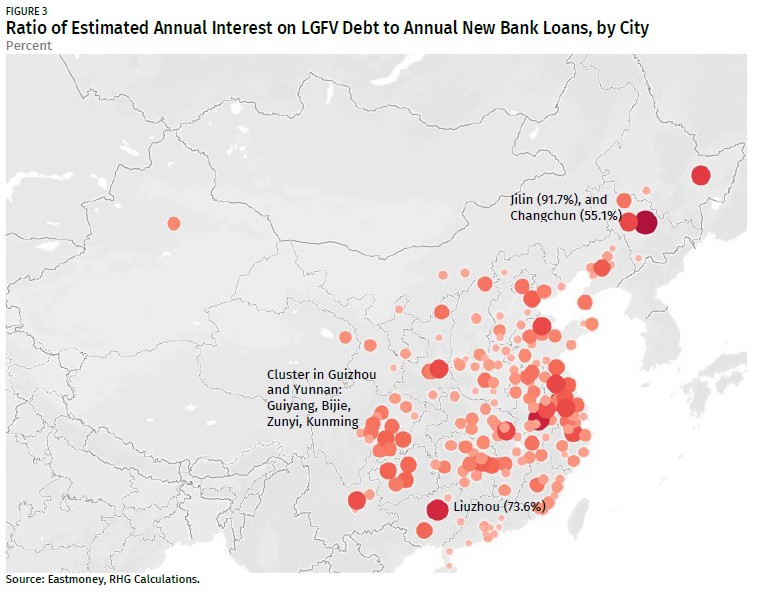

In addition, the geographic distribution of LGFVs’ high-interest borrowing is also highly uneven. As debt service has become unsustainable, LGFVs have begun to default on shadow banking instruments, and these defaults are increasingly priced into localities’ borrowing costs. While it is not possible to know the shadow funding rates for each individual city, coupon rates on local LGFVs are a reasonable proxy to estimate interest expenses conservatively (bonds are probably among the cheapest of LGFVs’ financing tools). And even under this conservative scenario, annual interest expense for 49 cities out of the 208 we surveyed accounted for more than one-third of 2017 new bank loans by city (Figure 3).

Implications for Policy: Reactive Measures Before Bailouts

China’s policymakers are more likely to be reactive to local government financial stress rather than proactive in managing that stress. This is primarily because Beijing has an interest in “constructive ambiguity” toward local government debt: a signal of widespread guarantees would only cause the debt problem to expand. Even though some bailouts will be necessary, Beijing will probably only provide such assistance sparingly and at the last minute. Eventually, however, expect the Ministry of Finance and central bank balance sheet to provide additional central government support in firefighting the financial stress building at the rural and city levels of government.

This has significant implications for counter-cyclical monetary and fiscal policy in 2020, which will be less effective as localities need to devote large volumes of new credit and fiscal resources to managing existing debt burdens, while even this support will not necessarily reduce the risk of credit events.

The 2020 wish lists for China’s local government officials are likely to include new bailouts of local debt. But the debt levels are just too large at this point, with total LGFV borrowing alone around 49 trillion yuan (a bit below half of 2019 GDP) and local government implicit debt estimated conservatively at around 30 trillion yuan. The best that policy-makers are offering to local officials at right now is the informal use of cheaper bank loans to swap out local governments’ more expensive implicit borrowing: this appeared to boost loan levels in August and September, while credit demand throughout the economy has been weakening (See Nov 12, “Banks Battling Weak Credit Demand”). In the short term, this will reduce localities’ interest burdens when replacing 10% funding costs with bank loans at 5% or lower, but it will not reduce local governments’ overall debt levels.

The most plausible method that Beijing outlined for local governments to repay debt is the sale of local state-owned assets, which is not easy in the current economic climate. For example, Tianjin Real Estate tried to sell a stake held by a local SASAC under mixed-ownership reform, but it was still unsuccessful. Two potential buyers, the Beijing-based military firm Poly and another Tianjin-based developer Sunac, famous for its aggressive mergers and acquisition deals, both quit the process after several months’ due diligence work. Stress is likely to materialize before significant local asset sales.

For banks, the 1990s bailout of the Big Four was an attempt to address the exact same types of policy-directed problem loans as in the post-crisis period. In the 1990s, however, loans were backed by property and fixed assets as collateral. Today’s LGFVs are mostly shell companies with no real underlying assets nor cash flows. For now, local government loans still appear safe and implicitly guaranteed. But before Baoshang’s failure, no one expected an outright bank default in China either.