Chinese FDI in the United States: Q1 2013 Update

After a weak fourth quarter 2012, FDI transactions by Chinese firms in the US are trending up again, and with more than $10 billion worth of deals announced or pending the pipeline is stronger than ever. This note discusses the key trends, transactions and political developments in the US-China investment relationship in Q1 2013.

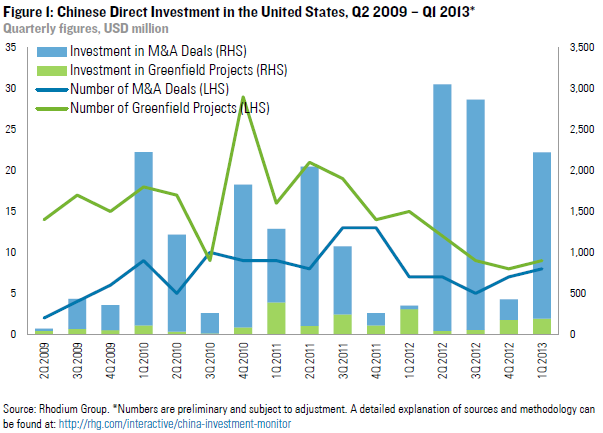

Inflows are picking up again and more deals are lined up: In Q1 2013 Chinese firms completed eight M&A transactions and nine greenfield projects, together worth $2.2 billion. Chinese US acquisitions currently under discussion or awaiting regulatory approval amount to more than $10 billion, the strongest pipeline we have ever recorded.

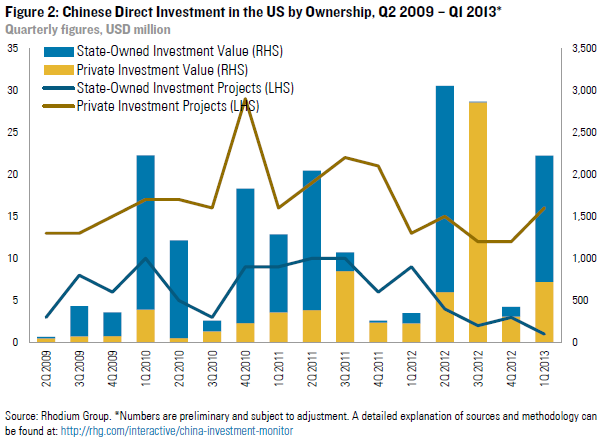

Private firms are stepping up their US investment: In the past 15 months private Chinese firms spent more on US deals than in the 11 years before combined. In the same period they accounted for 80% of transactions and 50% of total transaction value, a dramatic change compared to previous years when state-owned firms dominated Chinese capital flows to the US.

Chinese firms are increasingly capable of managing complex deal risks: The recent track record of Chinese investors illustrates that they are increasingly capable of closing complex transactions and successfully operating in the US regulatory and political environment.

Trends and Patterns

In Q1 2013, Chinese firms spent $2.2 billion for eight acquisitions and nine greenfield projects in the United States. Closed M&A transactions include CNOOC’s acquisition of Nexen’s US operations, Wanxiang’s $257 million takeover of bankrupt A123 Systems, BGI Shenzhen’s purchase of Complete Genomics, Hanergy’s acquisition of MiaSole, and Shanghai Fosun Pharmaceutical’s stake in Saladax Biomedical. The most prominent greenfield projects were a manufacturing facility by Shenzhen Superwatt Power International in Virginia, a joint venture by China’s biggest property developer Vanke with Tishman Speyer in San Francisco, and new offices by search engine giant Baidu in California that are said to be expanded into an artificial intelligence lab. Those deals underscore that high-tech manufacturing and modern services are emerging as mission critical for Chinese investors as their fast-changing home economy matures.

Another trend is that private enterprises have become an important driver of Chinese investment in the United States. From 2000-2011, private firms (which we define as firms with less than 20% government ownership) accounted for more than 70% of transactions, but state-owned enterprises still dominated in value terms (70% of deal value in the same period). Since the beginning of 2012 those patterns have started to change, with private firms accounting for 80% of transactions and close to 50% of total transaction value. Out of 17 deals recorded in Q1 2013, 16 were done by privately owned firms.

Two factors are responsible for this shift. For one, investments by SOEs dropped over the past year, possibly due to the political leadership transition and the related re-shuffling of executive teams at major Chinese SOEs. Second, we observe that private firms are now interested in medium and large-scale deals, not just the smaller transactions seen in the past, and they are increasingly capable of managing those investments. In the past 15 months private firms have spent as much money on FDI transactions in the US as in the 11 years before combined.

The acquisition of several firms with a significant workforce in Q1 2013 (A123, Nexen, Complete Genomics, Miasole) pushed up the number of US jobs provided by Chinese-owned entities. We estimate that the US subsidiaries of Chinese firms employed around 32,000 people at the end of Q1 2013, up by 2,000 compared to the previous quarter. Several firms are also hiring for new greenfield facilities (like Lenovo’s planned manufacturing operations in North Carolina) or the expansion of existing US operations (for example Nexteer, which intends to hire an additional 325 workers for its manufacturing and R&D facilities in Michigan). On the downside, the closure of Suntech’s solar panel manufacturing facility in Arizona lead to the loss of about 100 jobs, reminding us that Chinese firms are not immune from market volatility.

The RHG China Investment Monitor is now updated and allows for a comprehensive view on patterns of Chinese investment from 2000-Q1 2013 by entry mode, ownership and geographic location.

Key Transactions

Wanxiang – A123 Systems: A Demonstration for How US Deals Are Done

After a long battle, Wanxiang Automotive in January 2013 closed the acquisition of battery manufacturer A123 Systems. Aside from underscoring the technology component of Chinese deal-making in the US, the deal is particularly significant as it sends a strong signal to Chinese investors and policymakers that even difficult deals can be done in the US with the right strategy and the right partners.

Wanxiang had to battle with various concerns: first, it had to pass CFIUS’s review among warnings from domestic defense lobbyists about the sensitive nature of A123’s battery technology; second, the firm had gotten funds from the Department of Energy under the American Recovery Act and politicians were criticizing the deals as state-sponsored technology transfer to China; third, local competitors that were interested in the same assets and tried to politicize the deal. Despite those headwinds, Wanxiang managed to convince A123’s management, the bankruptcy court, regulators and other stakeholders of the desirability of its offer and found ways to work with CFIUS on divesting security-related assets. After completing the deal, Wanxiang America’s President Pin Ni sent a clear message to other prospective investors on how to get US deals done: “You just need to understand the rules, follow the rules, be very transparent and let them make the decision.”

ENN: Building the Infrastructure for the US Natural Gas Boom

In past years the largest Chinese state-owned energy companies (Sinopec, CNOOC, CNPC and Sinochem) have put significant capital into the development of unconventional oil and gas resources in the United States. In Q4 2012 the first private Chinese company, Haimo Oil & Gas, invested in a US shale play, a $27.5 million joint venture with Texas-based Carrizo Oil & Gas. A new initiative led by China’s largest privately-owned energy company shows how Chinese firms also seize opportunities in the infrastructure sector arising from the unconventional oil and gas boom in the United States.

In a joint venture with Utah-based CH4 Energy Corporation, China’s ENN Group has begun to build a nation-wide network of natural gas fueling stations for trucks along US highways. The first two “Blu LNG” fueling stations for trucks are already operational in Utah and four more are under construction. The company plans to build up to 50 more stations throughout the United States this year. ENN, which already operates an extensive natural gas supply network in China including more than 200 gas stations, is the first Chinese private company that is entering the US LNG infrastructure market. Its major competitor will be Clean Energy Fuels Corp., which already owns around 70 stations in the US. In February, ENN also announced a partnership with Westport Innovations, a developer of truck engines powered with LNG. The entry of ENN can bring expertise to the emerging US natural gas transportation market and accelerate the build-out of infrastructure necessary to make commercial use viable in the long term.

Policy Developments

National security remains the dominant topic in the US-China investment relationship. A federal court confirmed the role and position of CFIUS in response to a lawsuit brought by Sany-related Ralls, but allowed the firm to proceed with its due-process claim. Meanwhile, the public debate in thefirst quarter was dominated by a report documenting large-scale cyber espionage efforts originating from China and associated with official actors, setting a negative tone for the overall US-China economic and political relationship.

United States: Clarifying CFIUS Mandate and Debating Espionage Threats

In February the US District Court for the District of Columbia came to a ruling in a lawsuit filed by Ralls Corporation against a Presidential Order to divest assets it had acquired near a US Naval base. The federal judge dismissed Ralls’ claims of violations of the Exon-Florio Amendment as beyond the scope of judicial review, reaffirming the President’s broad authority to block foreign acquisitions based on national security concerns. However, the court allowed Ralls to proceed with its claim that the divestiture requirements were unconstitutional because they were not done through due process of law. In April, Ralls decided to proceed with those claims, citing earlier Supreme Court rulings against the federal government over alleged terrorist organizations. The next round of “Ralls vs. the US government” should help to clarify the extent to which CFIUS has to inform parties about the reasons for its decisions and the related procedures.

At the same time, CFIUS approved several Chinese transactions which had attracted heavy domestic resistance. In late December BGI Shenzhen received approval to acquire Complete Genomics despite claims it would pose biological warfare risks. The takeover of US assets of Canadian oil producer Nexen was approved in early February, but CFIUS reportedly imposed conditions through a mitigation agreement. In January, CFIUS green-lighted Wanxiang’s takeover of battery producer Wanxiang, despite strong criticism from commercial competitors and US defense lobbyists. The sale of A123 (and similar cases such as MiaSole or Fisker) also prompted lawmakers to introduce legislation to prevent foreign acquisitions of federally-funded technology firms.

Meanwhile, espionage concerns are increasingly impacting the US-China investment relationship. In February private security firm Mandiant released a report that documents systematic cyber-attacks originating from a military complex in Shanghai. Following the report, the US government and business executives have stepped up the rhetoric against government-sponsored cyber theft. The implications of these tensions for the broader China-US investment relationship are twofold. First, although the direct linkage between equipment and hacking remains unclear, recent dynamics will probably further shut the door for Chinese suppliers to participate in US telecommunications networks – some institutions are in fact even removing Chinese equipment from existing infrastructure, such as the Los Alamos National Laboratory. Second and more importantly, the allegations of state-sponsored hacking and the half-hearted Chinese response (“we are a victim too”) will damage the reputation of China Inc. among the business community and the broader public and create additional mistrust towards firms headquartered in China — which in turn may provide fertile soil for future attempts to politicize deals.

Along with alleged cyber-attacks, cases of “offline” espionage and violation of export control rules continued to make headlines. A December 2013 report by the Justice Department documents nearly 100 cases in which individuals or firms have been charged by the Justice Department with stealing trade secrets or classified information for Chinese entities or exporting military or dual-use technology to China. In January, press reports linked Huawei’s CFO to a company illegally offering HP equipment to Iran. In March, a Chinese citizen working for a NASA subcontractor was arrested by the FBI while allegedly preparing to flee to China with sensitive information. Another Chinese citizen was sentenced to more than five years in federal prison for violating the arms embargo by taking military information to China. In the same month, a US citizen was charged with handing over sensitive information to his Chinese girlfriend.

Cross-border regulatory cooperation remains another point of tensions in the US-China investment relationship. There was not much progress in the negotiations between China and the US on sharing audit working papers and allowing inspections of Chinese firms by foreign regulators. The inactivity on the Chinese side drew criticism from US officials, among them outgoing Chairwoman of the US Securities and Exchange Commission Mary Shapiro. Looking forward, the US Foreign Accounts Tax Compliance Act (FATCA) could open another front in US-China tensions over regulatory cooperation. FATCA, which will come into effect in early 2014, requires foreign financial institutions to report overseas holdings of US citizens. Last year officials from China’s central bank had criticized FATCA as burdensome and privacy-violating.

China: Fine-tuning the Regulatory Framework for OFDI

China’s top officials continue to criticize national security reviews of Chinese investment. At the sidelines of the National People’s Congress (NPC) in March, China’s Commerce Minister Chen Deming complained that “roughly one dollar of every three dollars we want to invest in the US gets approved”. He stressed that the criteria of the CFIUS review process were not transparent enough and said that China needs “clearer guidelines on what conditions might violate US security”. He added that CFIUS attached “unfair” conditions to the approval of the takeover of Nexen US through CNOOC.

At the same time, China continues to debate the overhaul of its own regulatory framework for outward FDI. At the NPC, firms and delegates called for better regulatory framework for OFDI. A comprehensive regulation that integrates and simplifies the existing layers of bureaucratic procedures (an “OFDI Law”) has been under discussion for several years but no breakthrough has been made. Two new regulations have come out in Q1 2013 that impact overseas investment decision-making: First, the Ministry of Commerce and the Ministry of Environmental Protection issued environmental protection guidelines for overseas investment projects, aimed at reducing related disputes. Second, following two pilot programs for easier transfer of FX across borders launched last year, the State Administration of Foreign Exchange in January officially announced a new office that will use part of China’s FX reserves to co-finance overseas investments by Chinese firms. The office was apparently created in 2012 but its budget, operational procedures and balance sheet remain opaque.

Outlook

As of April 2013, the pipeline of potential Chinese deals in the United States is stronger than ever, with deals worth around $10 billion currently pending or under negotiation. The most important M&A transactions pending are the $4.2 billion stake of a Chinese consortium in AIG’s aviation leasing unit International Lease Finance Corp. (ILFC); a bid for a 40% stake of the GM building in New York valued at $1.4 billion led by Soho CEO Zhang Xin; a $1.5 billion real estate project in Oakland by Zarsion Holdings Group in partnership with local developers; and a potential purchase of IBM’s x86 server business assets through Lenovo for up to $5 billion. The return of state-owned enterprises to global deal-making after the leadership reshuffle presents significant potential upside for Chinese investment in the US in 2013.