China’s Global Outbound M&A in 2015

Global cross border mergers and acquisitions (M&A) reached a six-year high in 2015, with around $1 trillion worth of completed deals.

Global cross border mergers and acquisitions (M&A) reached a six-year high in 2015, with around $1 trillion worth of completed deals. Chinese companies have evolved as an important driver of global deal making in the past decade. This note reviews Chinese outbound M&A activity in 2015, illustrating China’s transition from big buyer in extractive sectors to a more mature player across the full spectrum of industries.

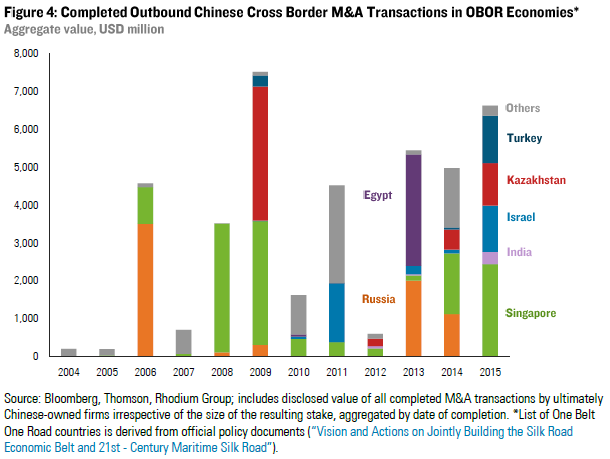

China’s global M&A spending reached the highest level ever recorded: Chinese firms closed transactions worth $61 billion in 2015, up 16% from 2014. China’s share in global cross border M&A transactions, however, remained well below its peak of almost 10% in 2013, reflecting stronger relative growth of outbound M&A in other parts of the world.

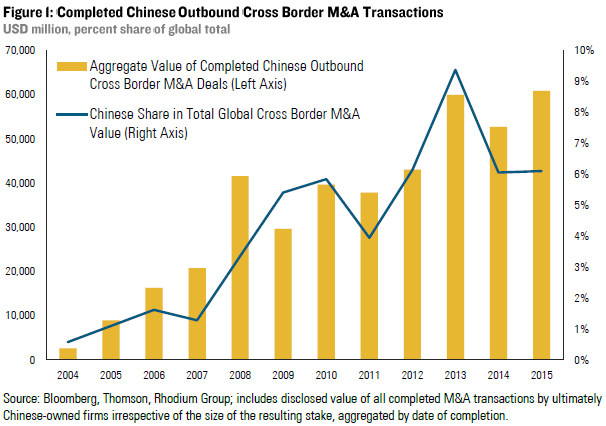

Chinese buyers target a more diverse and mature mix of assets: The appetite for energy and materials assets has plunged further, accounting for only 16% of 2015 spending, down from a peak of 83% in 2011. The recent drop in asset prices has not yet triggered opportunistic buying at a significant scale. However, Chinese investment in virtually all non-resources sectors increased last year, with financials, industrials, high tech, entertainment, and real estate recording the biggest jumps.

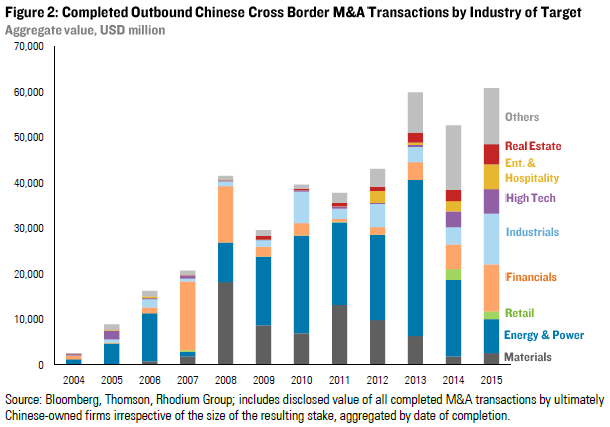

Advanced economies now receive the majority of Chinese capital: Greater appetite for mature assets and better awareness of political and commercial risks in emerging economies have further accelerated the shift of investment activity from developing to advanced economies. Europe, the United States, and Australia accounted for almost two-thirds of all Chinese outbound M&A transaction value in 2015.

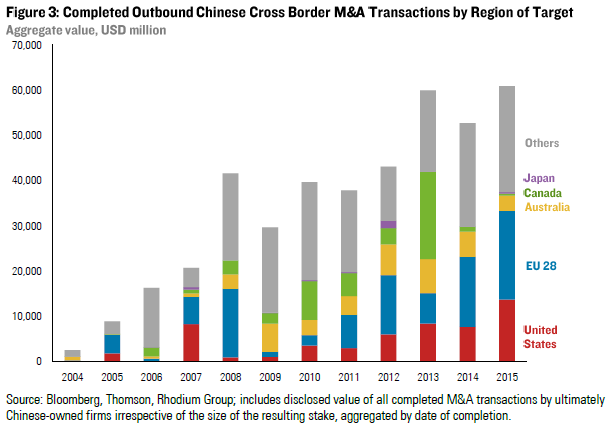

Policy has so far not boosted M&A activity in the OBOR region: Under its new “One Belt One Road” strategic initiative, China is encouraging companies to expand their investments in economies along the ancient Silk Road. While some of the OBOR countries recorded significant Chinese investments in 2015 (Israel, Kazakhstan, Turkey), the aggregate level of Chinese M&A activity in OBOR economies has not increased substantially since OBOR was announced in 2014. This suggests that either there is a longer time lag for these policies to translate into deals, or that investors prefer greenfield FDI, loans, and other modes to gain exposure to those markets.