China’s 2021 Growth: Targets and Truths

After a tumultuous pandemic year we need a sober assessment of where China’s economy stands and how GDP is likely to evolve in 2021

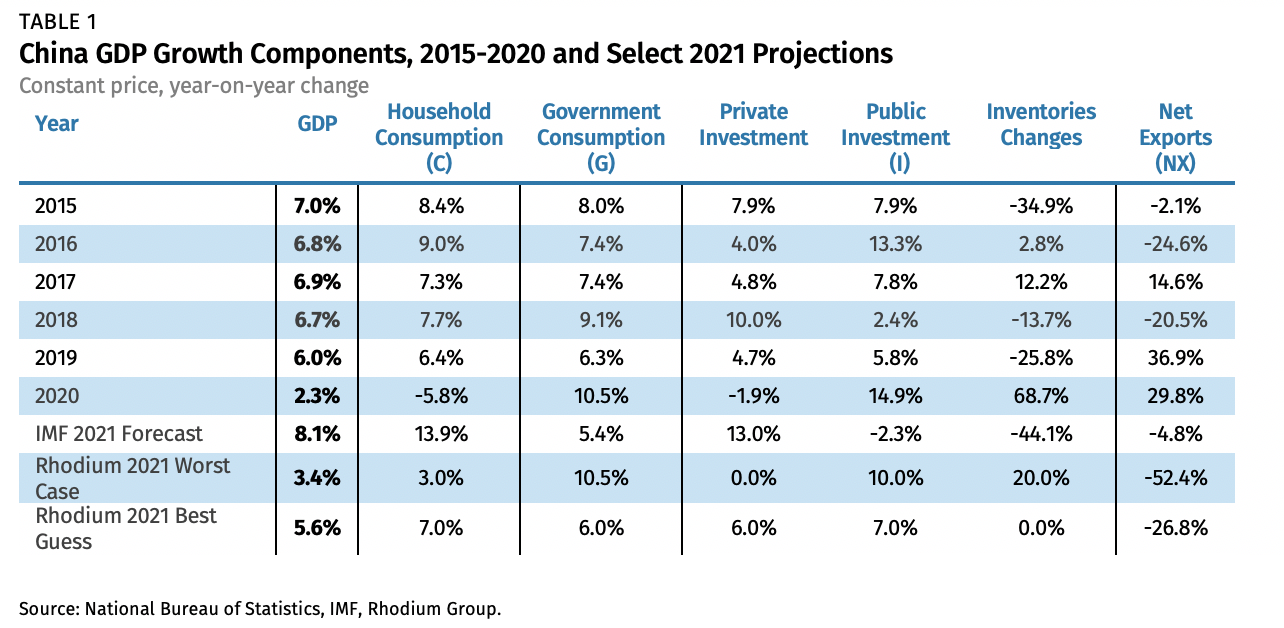

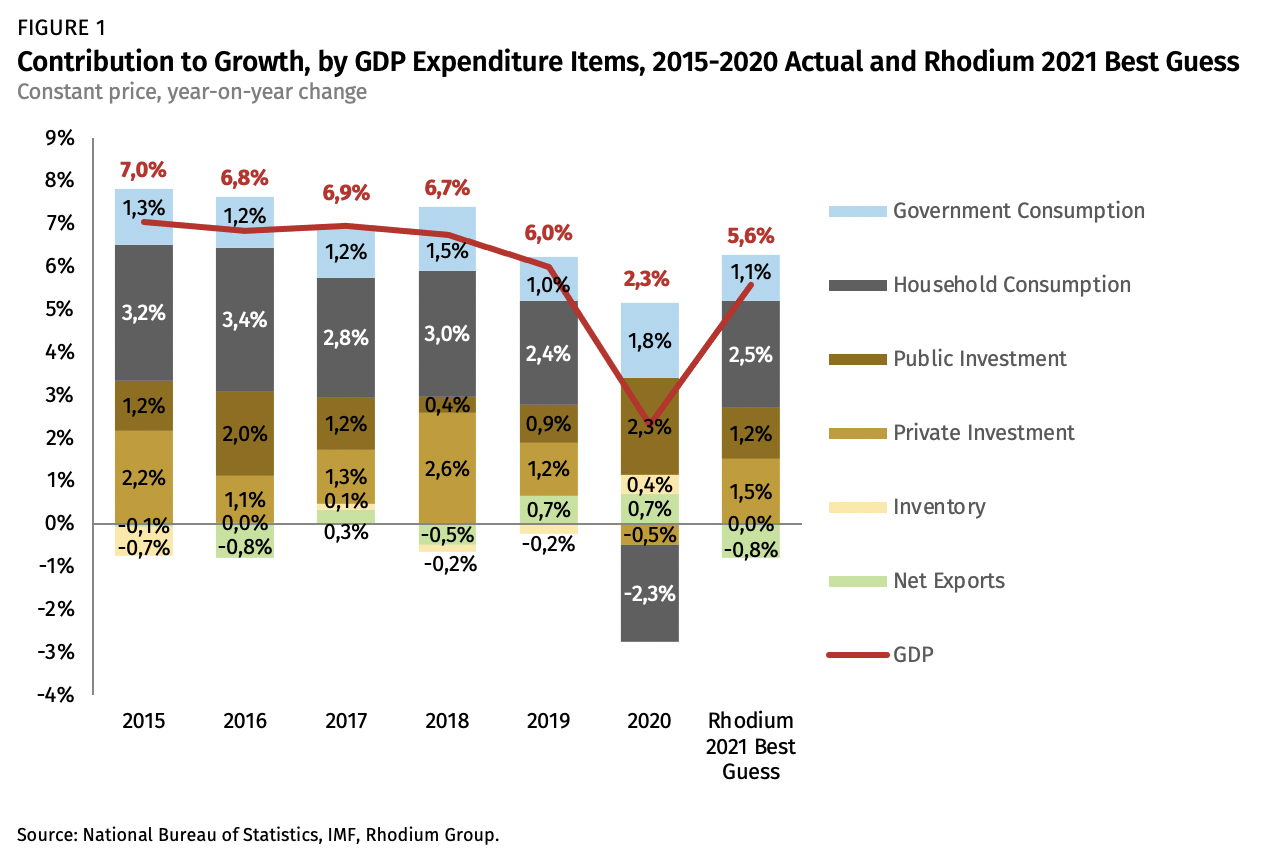

GDP Growth in 2020

Despite COVID-19, China reported headline GDP growth in 2020 (+2.3%, see table 1), driven by three factors: government spending spiked (+10.5%), net exports boomed (almost +30%), and within investment, there was growth, despite a collapse in private investment, thanks to public capital outlays (+14.9%) and epic inventory stock building. That was enough to offset the first absolute value decline in household consumption in the modern era (-5.8%). Beijing achieved this with expanded budget deficits, orders for bank forbearance, and instructions that state-owned firms invest. It posted a record trade surplus thanks to falling imports and booming exports, as global demand for COVID-19-related goods, from PPE to home electronics, soared. Authorities also revised 2019 growth lower, a move which automatically boosted the year-on-year growth rate for 2020 (whether that was reasonable or an accounting trick is debatable).

Growth Scenarios for 2021

The 2020 growth pattern was exceptional due to the pandemic. Double-digit increases in government spending and public investment threaten to exacerbate already severe systemic debt risks. Beijing has signaled that it intends to dial down fiscal stimulus levels, but if private activity (consumption and business investment) doesn’t recover, that is unlikely to happen. Mushrooming inventory levels cause deflation. The trade surpluses of 2020 happened despite a strengthening renminbi because China was the producer of last resort for a locked-down world.

The 2021 outlook hangs on three questions. First, how will the pandemic shape economic activity in China and the rest of the world, and will there be a reversion to “normal”? Second, how will advanced economy pushback against China evolve, and will it affect external balances or alter investor and consumer confidence about the future? And third, what will China’s policy approach look like? We heard a lot about “dual circulation” last year, but we have yet to see what it means for growth. We use this triptych of questions to craft full year 2021 scenarios for China. Note that the first two factors are largely beyond Beijing’s control. China will be affected by the course of the pandemic beyond its borders, and decoupling will continue in some form despite the departure of Trump. As for Beijing’s economic choices, they will be constrained by debt and domestic policy tensions, as former officials have noted publicly (such as ex-Finance Minister Lou Jiwei).

After shrinking due to the pandemic in 2020, China’s household consumption and private business investment should, all things being equal, bounce back to pre-COVID levels in 2021. But consumption growth in China had already been slowing in recent years due to weak household income growth. The most important source of household income is wage growth from an expanding private sector, but the drift away from marketization is diminishing that. Households have relied on debt so much to fuel their consumption that the 4Q20 PBOC monetary report argues, ponderously, that it is not right to use consumer finance to boost consumption. A 2020 freefall in birthrates may or may not by a one-year phenomenon, but a demographic contraction is certain this decade. Private business investment has been souring for years due to negative policy signals, decoupling risks, and now the disruption from COVID.

A bullish China growth case for 2021 depends first and foremost on controlling the pandemic at home and abroad, and shoring up global demand. The IMF’s economic projections for China in 2021, from the December 2020 World Economic Outlook (WEO), present the optimistic case (Table 1, line 7). In this picture, the twin thrusters of consumption and private investment lead the way to 8.1% GDP growth. Household consumption growth is projected to be the strongest in decades, at almost 14% year-on-year. There is a healthy rebalancing within investment: inventory building reverses dramatically (people are actually buying what manufacturers make!), and SOEs can pull back from wasteful public investment projects because private business investment soars to growth levels not seen since the Hu Jintao years (13%, the highest since 2011). After two consecutive years of booming net exports growth there is nowhere to go but down, but in a modest way, with the 2021 surplus just 5% smaller than the historic high of 2020. Government spending expands but at a moderate pace (5.4%, versus 9.6% in 2020).

There are some important corollaries to take away from this scenario. First, if it does happen, we will know it’s real, because it is based on private business and consumer behavior that is hard for Beijing to fudge. The drivers of China’s reported growth of 2.3% in 2020 were the opposite—government spending, public infrastructure and SOE investment that authorities could pump up (albeit at the risk of a future debt crisis). Second, because it is growth we can believe in, this outcome would encourage global portfolio investment into China. Short-term flows “chased yield” in China in 2020, but long-term value investors are sitting on the fence. If China pulls off a private sector comeback, global funds will be all-in. Third, this vote of confidence by global investors would color the geopolitical debate, because it would suggest that China’s model is not at a dead end. Whether liberal democracies would respond by building higher fences or more bridges to Beijing is another question.

But much could go wrong with this bullish story. China might not have the second largest current account surplus in history. Other nations might push back, reshoring more of what they import from China, and insisting that Beijing buy more of their products. China’s commodity import prices might go up with a global recovery, and “services imports” might rise again with a resumption of tourism (which hides capital outflows too). The renminbi could rise, pushing down China’s exports. China’s surplus could fall from $366 billion to perhaps $200 billion—still huge, but enough of a drop to knock a full point off growth. Major domestic corrections might drain the animal spirits out of private firms and citizens. The bankruptcies roiling Chinese capital markets since last year could mushroom, frightening businesses and individual investors. A property market correction could drain wealth from middle-class consumers. In this scenario, where external surpluses fall and consumers and private investors stay home, we assume Beijing would push up government spending and public investment. This storm of bad news outcomes is reflected in line 8 of Table 1 (“Worst Case”). It would push growth down to perhaps 3.4%.

There are important implications from this scenario too. First, the healthy rebalancing of investment in the IMF picture does not happen. Another year of low or negative returns on state investment is added to the nation’s ledger. Rather than reduced public over-investment, official outlays increase by $239 billion (for $2.6 trillion in public investment total). Second, this growing debt picture and the failure of private players to take the baton scares off portfolio investors. This forces Beijing to maintain higher yields on debt to attract needed inflows. Third, a failure to cheer private sentiment fuels a debate about the soundness of Beijing’s economic model.

Our Best Guess

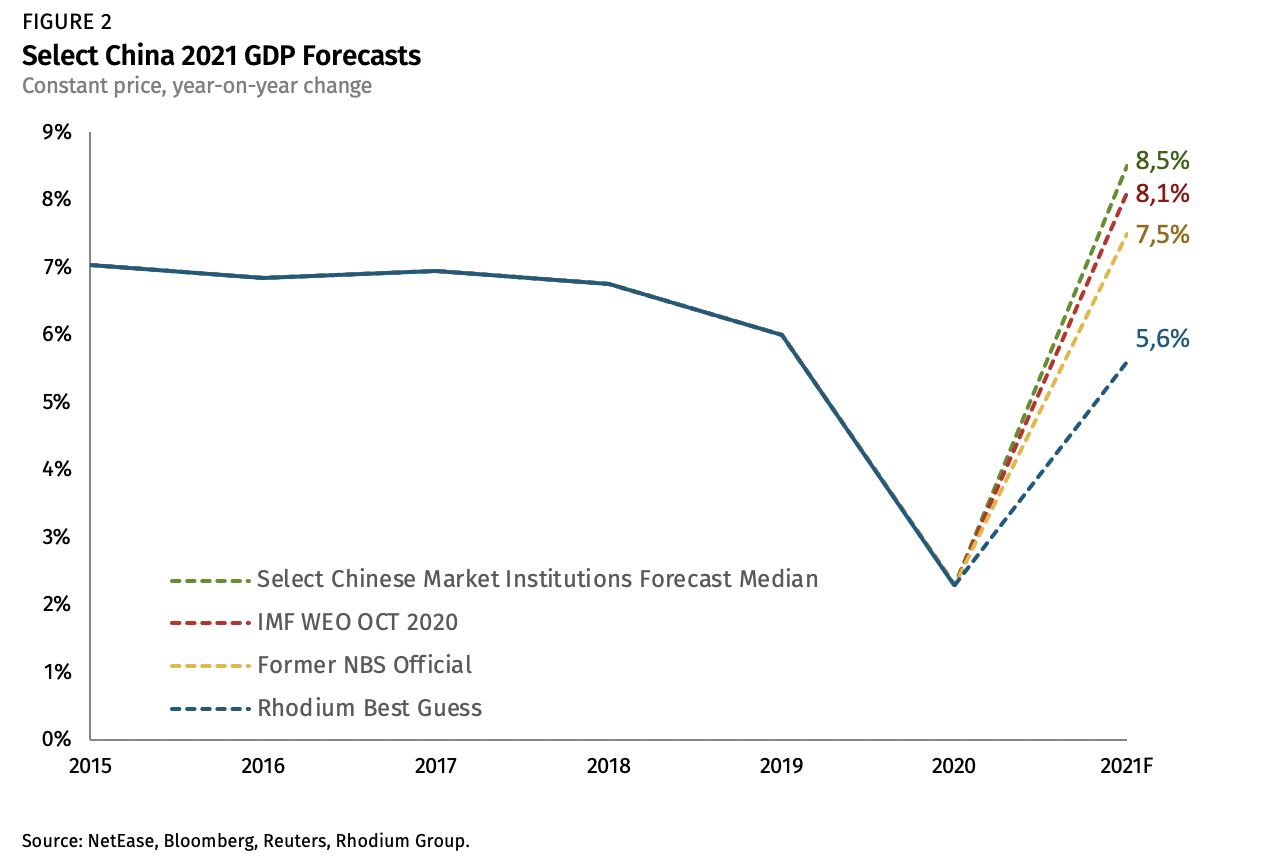

Taking all these arguments into account we arrive at our “best guess” for China’s 2021 GDP growth (Figure 2; line 9 of Table 1). Before we elaborate, we note there are two kinds of projections for China’s GDP. There are estimates for the result Beijing will declare, and there are estimates for what will “really” happen. The projection we offer here is the first kind: the number Beijing will be able to report. Leaders surprised at the National People’s Congress in March in two ways: first, by announcing a growth target at all given the idiosyncratic nature of the 2021 bounce from a COVID-hit 2020; and second because the target they did announce was “6% or better”, compared to the 8% that was widely expected. International authorities think 6% is unrealistically low, and that Beijing will almost certainly perform much stronger. Perhaps Beijing is signaling that it needs to clean up its debt-trapped domestic financial system, and offering a lower GDP target was the best way to do that. Perhaps 6% is close to the five year, 2021-25 average leaders have in mind, so they thought it prudent to start the period with that number on the table.

In any case, our best guess based on the fundamentals (and arrived at before Beijing announced its target number) is middling 2021 GDP growth of 5.6%. This puts us much lower than other forecasts but very close to what has since become the official number. A January 2021 Bloomberg survey of economists foresaw growth of 8.2%. This mirrored Chinese media surveys which showed domestic forecasts averaging 8.5%. In a recent interview, former NBS chief statistician Xu Xianchun—a respected voice—predicted 7-8% (7.5% in the below chart). Figure 2 summarizes these forecasts, including the IMF WEO projection discussed above, and our best guess.

Three factors explain our take. In our view, China’s twin engines of household consumption and private investment bounce back in the first half of this year due to base effects, but not robustly, and with failing momentum in the second half. The IMF view has consumers spending $650 billion more in 2021 than they did last year, close to the soaring pre-COVID regression line. We are more sceptical. We see both food and core consumer price indices pointing to more weakness (deflation) ahead, which does not auger well for consumption. Household income growth—the wellspring of consumption—will be a challenge until the private Chinese firms that account for 80% of urban employment feel confident that they have a place in the Communist Party’s vision of the future. And worries about the stock market and property sectors are going to weigh on spending. We can imagine a $350 billion consumption increase over last year, still an all-time high, but not the 14% growth buying spree the bulls believe in.

Second, we differ on the investment story. The IMF projects that gross capital formation growth in will slow slightly in 2021, to 5.6% for the year, from the 5.7% it computed for 2020. Our guess is that investment growth must increase to make up for weaker consumption growth. And the mix within investment is totally different in our view. Private investment recovers poorly, so public sector investment must keep booming and inventories remain steady at high levels. In other words, there is none of the rebalancing away from state-driven growth which others suggest. And third, we do not see Beijing’s huge trade surplus coming in at nearly the same levels in 2021. We see it declining from $420 billion to a still massive but lower $308 billion.

In sum, we see China enjoying much less growth from private demand in 2021: $342 billion less than the IMF sees in household consumption, $252 billion less in private investment, and $94 billion less in net sales to foreigners. That is $687 billion less from these three items, taken together. And we project $305 billion in additional public expenditure (more government consumption and public investment, and support for inventories) to prop things up therefore. This puts us reasonably close to the official headline growth floor target of 6%.

Long Term Assumptions Shape Short Term Projections

Forecasts of China’s growth diverge partly due to different assessments of the country’s long-term growth potential. One view (the Xu Xianchun case) is that potential growth over the coming decade will average 6%. Based on this projection, one would expect a 7%-9% growth rate for the years ahead.

Such rosy estimates rely on an assumption that promised reforms will happen. Recent experience suggests otherwise. We do not see reform taking shape, though we wish we did. Barriers to private activity remain severe, with state dominance on the rise. This is not just a pandemic era problem: it is characteristic of the past decade. The 2019 World Bank report “Innovative China” and other research stresses that growth potential depends on reform. While a “comprehensive/moderate reform” path could produce average Chinese growth of 5.1% between 2021-2030, the report sees more modest growth of 4.0% under a “limited reform” scenario. We monitor China’s reform efforts in our China Dashboard, and expect “limited reform” progress at best, with a risk of “reform reversal”.

The engines of China’s past growth have run their course (demographic dividends, the property boom, the heyday of infrastructure investment, net exports, the torrent of generous technology sharing by eager foreign firms). There are new sources of expansion available (household consumption, private investment) but political and regulatory reforms are needed to unleash them. That reform has started but repeatedly stalled in the Xi years due to concerns about economic and political instability. In 2020 alone, two systemic reform programs were announced. “Market allocation of factors of production” sounds good in principle, but it is academic, and distant from reality. “Dual Circulation”, the big new idea, is problematic on several levels. It is unclear what it means, and to the extent it has been elaborated, it sounds like more intervention and economic nationalism. Private firms and households don’t know what to make of it. We see a preponderance of systemic risks—financial and structural—weighing down sentiment beneath China’s veneer of stability and confidence. And geopolitical challenges are another impediment to robust reforms that would unlock sustainable growth.

This is our biggest takeaway from this exploration of China’s 2021 GDP outlook through the lens of expenditure components. The policy interventions used to realize the world’s best performance in 2020 are unlikely to be repeated, and in any case would be a hindrance to future growth. Optimistic projections presume private sector resilience. Without those market animal spirits, it is hard to believe in growth above 5.6% this year, even though base effects may make the first half of 2021 seem like boom times.

(An Italian version of this note first appeared in Aspenia, the Aspen Institute Italia’s journal of international affairs)