A New Momentum for FDI Reforms in China

In July, China surprised observers by agreeing to negotiate a bilateral investment treaty with the United States including all sectors and stages of investment. And last week, China’s cabinet pushed for the suspension of existing FDI regulations for a new pilot free trade zone (FTZ) in Shanghai to replace them with more liberal rules. These are two strong signs China is preparing for a significant overhaul of its inward FDI regime. This note explores the political economy and implications of such reforms.

New momentum for reforms: The liberalization of China’s FDI rules has slowed in the past few years, but recent actions indicate the new leadership is pushing for a new FDI regime based on openness and pre-establishment rights for foreign investors restricted only by a negative list.

Domestic reform agenda and external pressures: More liberal FDI rules are in line with the domestic reform agenda and create a back door for implementing contentious reforms at home. Better institutional capacity to regulate inward FDI and increasing dissatisfaction abroad with asymmetries in market access are also important.

The path forward: Given the strong opposition from vested interests and the complexity of related reforms, it will take gradual steps over a longer period of time to overhaul China’s FDI regime. New FDI rules for Shanghai’s pilot FTZ will be an important indicator of the government’s seriousness and the direction of reforms.

China as FDI Powerhouse

The embrace of foreign investment was a pillar of China’s reform and opening up policy in the 1980s. To secure inflows of capital, technology, managerial know-how and back-links to export markets (and, thereby, foreign exchange earnings needed to make further acquisitions of critical equipment abroad and buffer against balance of payments crises), Beijing opened broad swaths of the economy to foreign investment at a very early stage of development. In order to restart growth after the 1989 Tiananmen Square debacle, Deng Xiaoping made the bold decision to open China even further to FDI in the early 1990s.

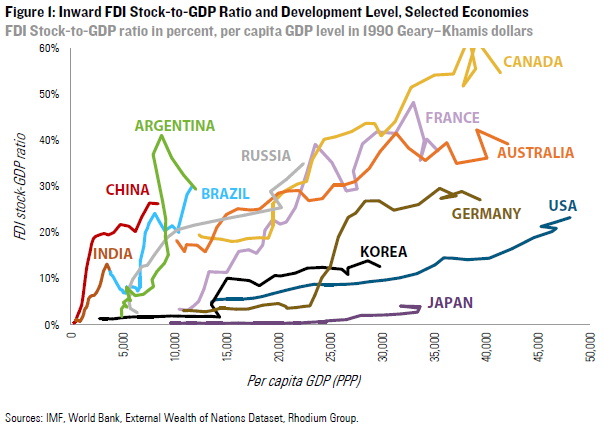

Those liberal FDI policies helped make China one of the world’s top destinations for foreign investment. Today, China hosts more than $2 trillion of FDI, which makes it the world’s second largest host of FDI after the United States. Despite being the world’s second largest economy, China has a similar or higher FDI stock-to-GDP ratio than many of its emerging economy peers, and its inward FDI stock is greater than that of Brazil, India and Russia combined. Historically, no other emerging economy was penetrated by foreign capital so early along the development path (Figure 1).

Barriers Remain

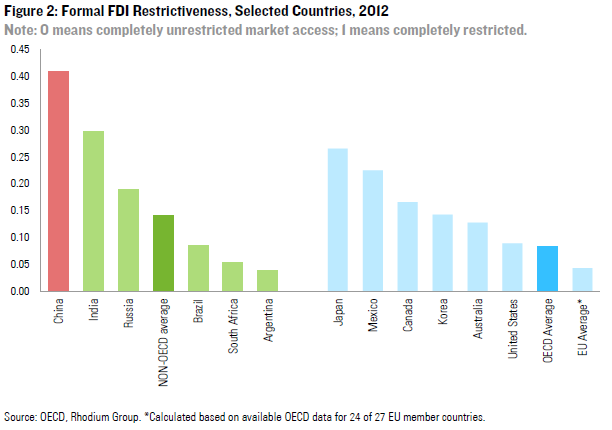

Even with aggressive liberalization and the massive inflow of foreign capital, China still has a long way to go to fully open up its FDI regime. China maintains a closed capital account and foreign investors need government approval for their projects; Beijing regularly publishes a catalogue listing the industries in which foreign investment is encouraged, restricted and prohibited. In addition to outright limitations on foreign equity ownership and approval mechanisms, there are also limitations on the employment of foreigners as key personnel and operational restrictions. With regard to formal FDI restrictions, China is still one of the least open of the G-20 countries (Figure 2). And surveys by industry associations suggest informal discrimination against foreign firms is rampant as well, especially in fast-growing sectors like services and high-tech.

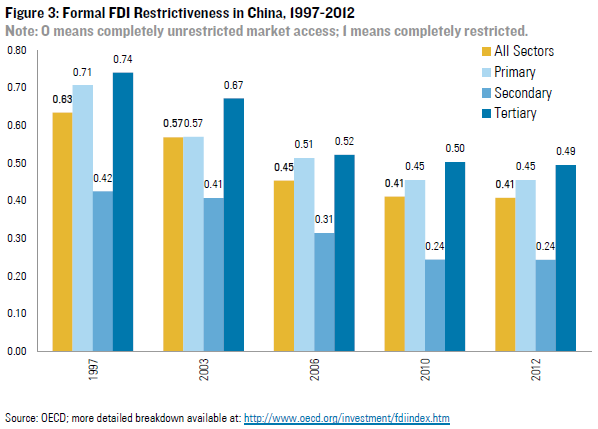

Compared to previous periods, the pace of FDI reform has slowed since the mid-2000s. The level of formal FDI restrictiveness has remained virtually unchanged over the past seven years, particularly in the tertiary sector (Figure 3). Moreover, informal barriers seem to have increased along with a general worsening of the business environment for private firms due to the Hu/Wen administration’s favoritism for SOEs and the stimulus policies following the financial crisis in 2008/2009. For example, the 2013 China Business Climate Survey Report from the American Chamber of Commerce in China shows a sharp fall in the percentage of businesses believing China’s investment environment is improving.

A New Momentum for FDI Reforms

Since China’s new leadership took office in March 2013, it has demonstrated a strong commitment to economic reforms. The liberalization of China’s capital account is seen as a central component of the reform agenda. Recent signals suggest that a shift towards a new type of FDI regime could be one of the first major steps towards a more open capital account.

The first signal of an upcoming change in China’s FDI framework was the government’s agreement in July to enter negotiations with the United States for a bilateral investment treaty (BIT) including all stages of investment and all sectors. The US and China have been talking about a BIT since 2008, but negotiations had been stalled since 2009, partially because the Obama administration was conducting a three-year review of the US model BIT, resulting in a new treaty template. China agreed to re-start negotiations on the basis of pre-establishment national treatment and a negative list approach. The former term indicates that national and most-favored nation status will be offered to foreign investors before an investment is established, such as in the early acquisition and registration stage. The latter term means that national and most-favored nation treatment will be provided in all sectors and on all levels except for those “blacklisted”.

China’s readiness to enter negotiations on those terms can partially be interpreted as a symbolic step to send a positive signal to the US in the context of the Strategic and Economic Dialogue meetings. At the same time, it is a significant deviation from its previous stance, and comparable terms will be sought by other economic partners lined up for BIT negotiations with China, such as the European Union. In short, it signals that Chinese leaders are preparing for a major shift in its FDI regime: from an approval regime with a positive list to a so-called negative list approach, where all sectors and investment stages not on the negative list are open to investment.

Another strong signal is the central government’s support for a new free trade zone (FTZ) in Shanghai, which will serve as a test case for more liberal FDI rules nation-wide. Similar to the Shenzhen special economic zone designed by Deng Xiaoping three decades ago, the new Shanghai FTZ is a pilot project to explore new models for regulating cross-border capital and trade flows. Amid a broader range of new experimental policies including currency, tariffs and financial services, more liberal inward FDI policies are emerging as a key focus for the new FTZ. China’s State Council said that the FTZ would offer an opportunity to “innovate” the opening-up model, test a negative list approach and reform the government’s role in regulating foreign investment. On August 16, the cabinet passed a draft document asking the country’s highest legislature to suspend certain laws regulating foreign direct investment for the territories of the Shanghai FTZ to avoid potential conflicts with new rules.

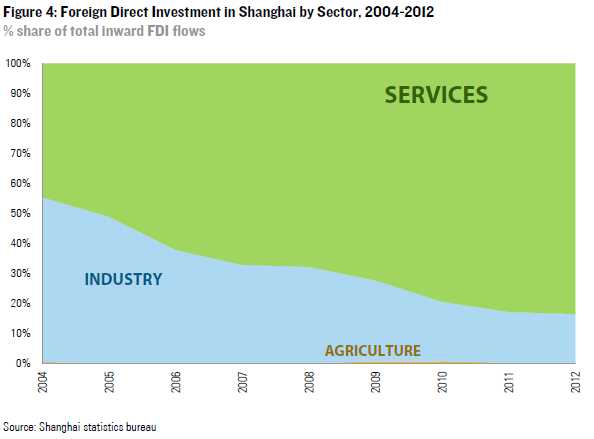

Shanghai’s development stage and economic profile make it an ideal candidate for testing a new approach to foreign investment. With a per-capita-GDP of more than $13,000, Shanghai is one of the most affluent and advanced local economies. It was at the forefront of China’s FDI boom for a long time and has absorbed more than 10% of the country’s total FDI inflows over the past decade. However, it has a very different FDI profile from most other local economies, with more than 80% of FDI targeting the tertiary sector, particularly modern services such as business services, trade and logistics, and information technology. It is particularly in those areas where the most regulatory hurdles exist, and the local government has repeatedly called for abolishing those barriers and restrictions in order to sustain those inflows in the years ahead.

What’s Driving This New Reform Momentum?

China’s readiness to further open up the inward FDI regime must be seen in the context of several economic and political developments. First and most importantly, the transition to a new growth model undermines the economic rationale for existing restrictions on inward FDI in many sectors, and services in particular. Abolishing existing restrictions on private and foreign investment in high-tech manufacturing and modern services will help unleash growth potential in those areas. More importantly, foreign investment could become a powerful vehicle for the government to push forward contentious reforms through the backdoor. Greater competition through trade in connection with the WTO accession helped previous leaders implement far-reaching reforms in the 1990s. A change in the FDI regime could become a similarly powerful vehicle, for example for the next phase of reforming sectors with state monopolies such as energy or finance.

Second, China is now ready to transition to a modern FDI framework, having built the necessary institutions in recent years. Most advanced economies today rely on three pillars for regulating inward FDI: competition policy authorities that review cross-border M&A and the behavior of firms after market-entry; a body screening FDI for national security threats; and sometimes a negative list that restricts foreign investment in certain industries. With its Anti-Monopoly Law in 2007 and a new national security screening body in 2011, China has now created two of those institutions, and a negative list can be derived from existing lists of restricted/prohibited sectors. In short, compared to five years ago, China now has the institutional foundations for making the shift to a modern regime with pre-establishment national treatment for foreign investors without giving up the ability to control for investments that could harm legitimate public policy interests.

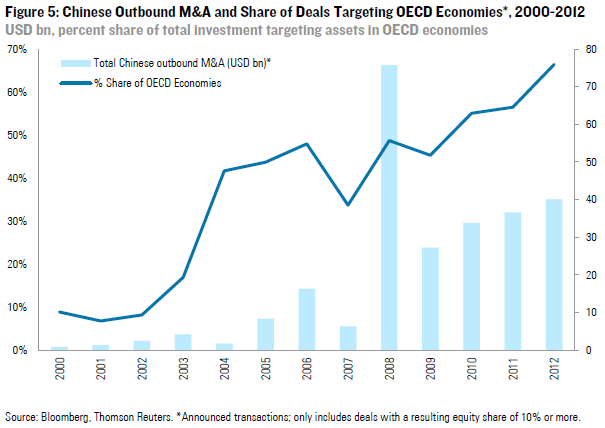

And third, China’s own firms now have more to lose from investment barriers abroad, and China’s current FDI regime is an increasing source of foreign misgivings about Chinese investment. Chinese firms were not significant players in global FDI for most of the past three decades, but China’s outbound FDI has taken off in recent years. In 2012, China became the third largest exporter of FDI behind the US and Japan, and there is increasing dissatisfaction from economies hosting Chinese investment with existing asymmetries in market access. This pressure has only grown more intense as Chinese OFDI is now increasingly targeting advanced economies with very open FDI regimes. Ten years ago, only 10% of announced Chinese M&A transactions were targeting assets in advanced economies. By 2012, more than 60% of all outward M&A by volume was targeting OECD economies (Figure 5).

The Path Forward

While recent signs of inward FDI regime modernization are encouraging, uncertainty lingers about the timing and sequence of reforms. FDI reforms are not independent of the rest of the reform agenda (in particular capital account opening dynamics), and there are strong vested interests opposing a more liberal FDI environment – especially in industries with natural monopolies, low levels of global competitiveness, and relatively minor overseas investment interests, such as financial services, logistics and media.

The dynamics of new FDI regulations for Shanghai’s FTZ will be a good indicator for the upcoming political battle over China’s new FDI regime. China’s highest legislature, the Standing Committee of the National People’s Congress, will review the State Council’s proposal to abolish existing rules for the FTZ during a meeting this week (August 26 – 30). If the proposal is approved, all eyes will be on the specifics of the new FDI rules, which are drafted by the Shanghai government and relevant central government ministries. According to the initial plan for the FTZ approved by the State Council in early July, the new FDI rules can be expected to incorporate central elements of a modern FDI regime: Pre-establishment rights and national or most favored nation treatment for foreign investors limited only by a negative list; simplified administrative procedures including a switch from an approval system to a registration system; and measures to level the playing field between domestic and foreign firms, including the suspension of qualification or performance requirements, limitations on equity stakes, and operational restrictions.

The behavior of other local governments will be another important indicator to watch. Competition for foreign investment is intense and other cities and provinces can be expected to push forward with their own initiatives if Shanghai should be granted special rules. In fact, a number of cities with special tax-protection zones have already filed or are preparing to file for the FTZ status, including Tianjin, Xiamen, Dalian, Shenzhen and Guangzhou. If those local pilot schemes are approved and successful, it won’t be too long before a modern FDI regime with pre-establishment rights will be implemented nationwide.